Loading...

Crypto.com (CROUSD)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

Cronos Crypto Price Financial Market

The cryptocurrency market is known for its volatility and rapid price changes, but some digital assets like Cronos (CRO) maintain an intriguing position in the market due to their association with established platforms and ecosystems. Cronos, originally launched as Crypto.org Coin, is a key token in the Crypto.com ecosystem, offering various features like staking, governance, and decentralized applications (dApps) support on the Cronos blockchain. As of December 2024, the price of Cronos stands at approximately $0.20 USD, reflecting a significant recent rise of over 11% in a 24-hour period.

Market participants often use the price of Cronos as a gauge of investor sentiment towards Crypto.com and the broader cryptocurrency market, especially in the context of rising adoption and increasing integration of blockchain technology. As with many altcoins, Cronos' price movements are heavily influenced by both macroeconomic factors, such as inflation and interest rates, and specific events affecting the Crypto.com ecosystem. Furthermore, the performance of dominant cryptocurrencies, especially Bitcoin (BTC) and Ethereum (ETH), often has a direct or indirect influence on the price action of smaller assets like Cronos.

The financial market for Cronos is characterized by frequent price fluctuations, and its value can be affected by changes in investor behavior, news, and overall market sentiment. The coin is an attractive asset for traders due to its connection to Crypto.com’s extensive user base, which spans crypto exchanges, DeFi platforms, and even physical debit cards. While Cronos has seen impressive growth, it remains susceptible to the inherent risks and speculative nature of the cryptocurrency market, where prices can swing drastically within a short period.

Overview of Current Cronos Crypto Price Trends

To understand the price movements of Cronos, it’s important to consider its recent trends. Over the past month, Cronos has shown an impressive upward trajectory, gaining nearly 180% in value. This surge is significant, especially considering the volatile nature of cryptocurrency markets, which are often driven by short-term factors such as market speculation, global financial news, and technological advancements.

As of December 3, 2024, Cronos' price hovers around $0.20, a level that has seen considerable movement. For example, just one week prior, the price was lower, at $0.18, highlighting its recent rise. This upward trend in price can be attributed to several factors, including a renewed interest in the Cronos blockchain, increased activity in decentralized finance (DeFi), and the broader recovery of the cryptocurrency market after earlier downturns. The surge is also aligned with an increase in the market cap, currently pegged at around $5.32 billion.

Cronos has displayed resilience during market volatility, with price trends reflecting both short-term fluctuations and longer-term patterns. These trends make it an appealing option for both short-term traders looking for volatility-driven profits and long-term investors who believe in the growth potential of the Crypto.com ecosystem. However, while the price of Cronos has been rising, it is essential to remember that cryptocurrency prices are notoriously volatile and unpredictable, subject to external influences ranging from regulatory changes to broader economic shifts.

Current Cronos Crypto Price Market Trends

The market trends of Cronos are deeply interwoven with the broader cryptocurrency market. At present, Cronos benefits from a significant level of market liquidity and volume, which aids in price discovery and reduces the volatility typically associated with smaller altcoins. Cronos' 24-hour trading volume has recently been recorded at $246.27 million, indicating a healthy level of trading activity. This high trading volume is indicative of investor confidence and interest, particularly as the coin gains in popularity among traders and investors alike. A key characteristic of Cronos is its position as the 28th largest cryptocurrency by market capitalization, which speaks to its broad acceptance and liquidity.

The price of Cronos tends to reflect broader market trends, especially the performance of Bitcoin and Ethereum. Cryptocurrencies often move in tandem, with altcoins like Cronos seeing price movements that are heavily correlated with the price action of Bitcoin. For example, a price increase in Bitcoin often leads to a rise in the prices of smaller altcoins as investors seek higher-risk, higher-reward assets.

Investor behavior is also a crucial factor. Over 98% of Coinbase users, for example, have been actively buying Cronos over the past 24 hours. This active buying interest suggests that many traders are either betting on further price increases or are capitalizing on short-term market momentum. The increased trading activity and demand for Cronos further demonstrate the growing adoption and utility of the coin within the Crypto.com ecosystem.

Factors That Affect Cronos Crypto Price and the Cronos Crypto Market

Several factors contribute to the fluctuations in the price of Cronos. These include:

- Market Sentiment : Sentiment plays a crucial role in the cryptocurrency market. Positive news regarding Crypto.com or blockchain technology, in general, can lead to higher demand for Cronos, driving its price upward. Conversely, negative sentiment, often driven by regulatory developments or broader economic issues, can result in price declines.

- Regulatory Changes : Regulation is one of the most significant factors influencing the price of cryptocurrencies, including Cronos. Cryptocurrency regulations are constantly evolving, with governments worldwide taking different approaches. Changes in regulatory policy, such as the imposition of new taxes or restrictions on crypto exchanges, can have a direct impact on Cronos' price and investor confidence.

- Adoption and Utility : As a token integral to the Crypto.com ecosystem, Cronos benefits from the continued adoption of the Crypto.com platform. This includes the growing use of the coin in staking, governance, and decentralized finance applications. The broader adoption of the Cronos blockchain, along with its expanding DeFi and dApp ecosystem, provides long-term support for the price of Cronos.

- Supply and Demand : The price of Cronos is also influenced by its circulating supply. With a total supply of 100 billion tokens, the market price can be influenced by changes in the available circulating supply, either through new token releases or buybacks. If demand increases significantly, the limited supply of tokens could lead to price appreciation, while oversupply could push the price down.

- Technological Developments : Technological advancements within the Cronos blockchain ecosystem can influence the price of the token. Upgrades that enhance the functionality of the blockchain, such as better scalability or integration with new decentralized applications (dApps), can drive demand for Cronos and increase its value.

Other Related Cryptocurrencies Affected by the Price Action of Cronos Crypto

Cronos (CRO), the native cryptocurrency of the Cronos blockchain, is closely tied to the performance of its network, which facilitates decentralized finance (DeFi) applications, cross-chain interoperability, and decentralized applications (dApps). Due to its foundational role in the Cronos ecosystem, the price action of CRO can influence a number of other related cryptocurrencies in various ways.

One major category of cryptocurrencies affected by Cronos' price movement are those within the same ecosystem, such as tokens used for DeFi platforms on Cronos. These can include assets tied to decentralized exchanges (DEXs) like VVS Finance or other liquidity pool tokens. The performance of CRO often impacts the overall liquidity and trading volume on these platforms, influencing token prices.

Additionally, Cronos' relationship with Ethereum and other Layer-1 networks means that price action can extend to other cross-chain projects. Cryptocurrencies relying on the Cronos blockchain for interoperability, such as assets that bridge between Ethereum or Cosmos-based chains, can experience volatility tied to fluctuations in CRO.

The broader DeFi market is also affected by CRO's price action, as movements in one high-profile cryptocurrency often trigger reactions across various DeFi tokens, such as those in lending protocols or stablecoins operating on Cronos. Thus, CRO's performance can create ripples across the crypto market.

Conclusion

Cronos remains a compelling asset within the cryptocurrency space, offering strong potential for growth driven by its connection to the Crypto.com ecosystem and its increasing adoption in decentralized finance. However, as with any cryptocurrency, the price is subject to market fluctuations driven by investor sentiment, regulatory changes, and broader economic conditions. By staying informed about these factors, traders and investors can better navigate the volatility of the Cronos market and make more informed decisions when it comes to buying or selling Cronos.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

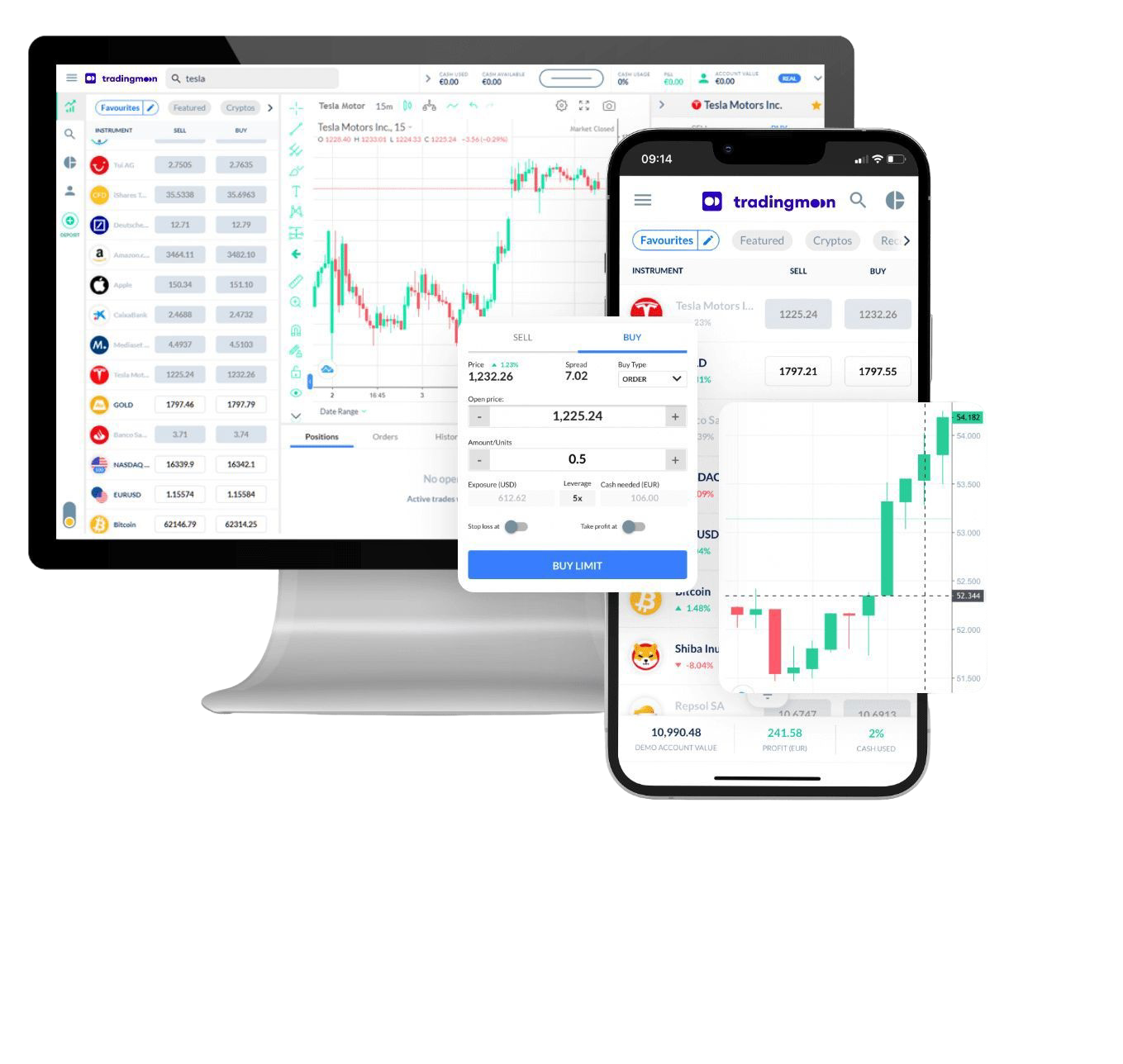

Trade [[data.name]] with TradingMoon

The most popular and trending cryptocurrencies, all in one place at the right time.

- Trade 24/7

- Minimum margin requirement below ~3$

- Spreads of just $0.50 on BTC - lower on other crypto! Plus a super low trading fee of 0.1%/side

- No withdrawal fees

- Diversify! 900+ instruments to choose from

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying crypto asset.

Crypto CFD

Physical Crypto

Capitalise on rising stock prices (go long)

Capitalise on falling crypto prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset or have an exchange account

No exchange fees or complex storage costs

Just lower commissions in the form of spreads and a small taker-fee

Manage risk with in-platform tools

Ability to set take profit and stop loss levels