Loading...

DJ 30 index

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

About

History

Differences between Investing vs Trading

About

History

Differences between Investing vs Trading

The US30 Industrial Average, known as the US30 or the US30, is a stock market index based on 30 of the top companies found on the different stock exchanges operating in the US.

This is a price-weighted index with a narrower focus than indices such as the SPX500, which covers more companies. However, with a history going back to 1896, the longevity of this index means that the US30 price is still followed by many financial experts and is the basis of numerous types of investment.

While the full name of the index includes the word industrial, this no longer reflects the current make-up. The 30 companies that this index tracks come from all different types of industries, from soft drinks to financial services and clothing. Some of the most well-known companies in the world are included in this index, such as Walmart, Apple, Microsoft, JPMorgan Chase, and Coca-Cola. The companies listed on it change from time to time, with a committee deciding upon any changes. None of the firms included in the very first issue of the index are still listed in the latest version.

The US30 index ended its first year of publication with a closing value of 39.29. By the start of the 20th century, it was over 10,000, and 2021 set a new closing record with over 36,000 at the end of the year.

This US30 price reflects the performance of the 30 individual shares in it and is also affected by wider economic conditions. If we look at the biggest daily gains made over the years, we can see that they arrived partly due to major events such as the passing of the Emergency Banking Act in 1933, which brought stability to the American banking system, and that led to a 15.34% increase in this index.

In the same way, the largest US30 price falls are linked to dates such as Black Monday in 1987 and the Wall Street Crash of 1929. Trying to work out the next crash or significant rise in the US30 price is one of the main goals for many people working in the stock market.

Since this is an index, you can’t directly buy shares in it. However, there is a huge market for financial products that are based on the US 30 price. Futures and options contracts based on the index are heavily traded, with these options typically used by more experienced traders or those willing to learn key skills.

Index funds such as mutual funds track and look to match the performance of the US30, although investors may have to pay fees that reduce the performance to below that of the index itself. Among the benefits of investing in a fund that tracks this type of stock market index is that it automatically creates a diversified portfolio when compared to single stock purchases.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

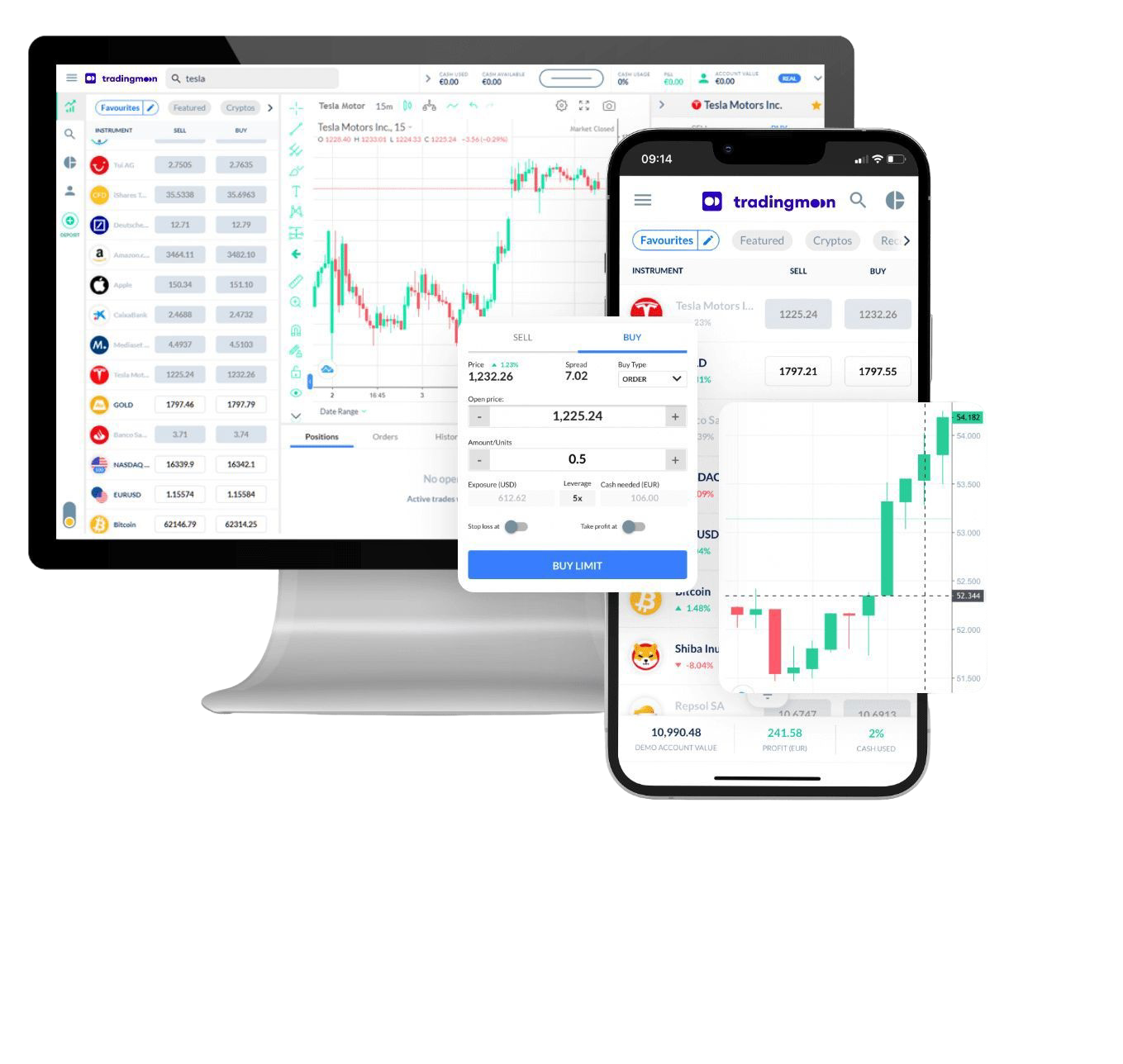

Trade [[data.name]] with TradingMoon

All major indices at industry-leading pricing.

Gain exposure to global markets via lower-risk, stock market indices.

- Trade 24/5

- Minimum margin requirements

- The tightest spreads

- Easy to use platform

FAQs

How is the US30 Industrial Average Index calculated?

+ -

The US30 Industrial Average (DJIA) is a stock market index that tracks the performance of 30 large, publicly-traded companies in the United States. The index is calculated by taking the arithmetic average of the stock prices of these companies. The DJIA is one of the oldest and most widely-followed stock market indexes in the world, and it is often used as a barometer for the overall health of the US stock market.

The DJIA is calculated and maintained by S&P US30 Indices, a subsidiary of financial data provider S&P Global. The index is reviewed and reconstituted every year in order to ensure that it remains representative of the US stock market. For example, companies may be added or removed from the index if they experience a significant change in their business model or become less representative of the US stock market as a whole.

Is US30 a good investment?

+ -

US30 is a good investment for a number of reasons. First, it is one of the most widely recognized and respected indexes in the world. This gives it a level of stability that many other investments lack. Additionally, the US30 is also home to some of the largest and most well-known companies in the world, which further adds to its stability. Finally, because the US30 is followed so closely by investors and analysts alike, it tends to be less volatile than other markets, making it a safer investment for those looking to generate long-term returns.

Of course, like all investments, there are risks associated with investing in US30 Index. The biggest risk is that of market volatility. Because the US30 is tracked regularly, any sudden changes in the market can have a significant impact on the value of US30 Index. Additionally, because the US30 is made up of large, well-known companies, it is also subject to fluctuations in the overall indices market. However, for investors willing to take on these risks, investing in US30 could be a great way to generate long-term returns.

What is the difference between the US30 and US100?

+ -

First and foremost, the DJIA only includes companies based in the United States, while the US100 includes companies from all over the world. Secondly, the DJIA only includes 30 large companies, while the US100 includes over 2,500 companies of all sizes. Finally, because it includes so many more companies, the US100 is generally more volatile than the Dow.

So, which index is right for you? If you're only interested in investing in large US companies, then the DJIA is probably a better choice. However, if you're interested in getting exposure to a wider range of companies, then the US100 may be a better option.

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying asset.

CFDs

Indices

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels