Loading...

Coffee (COFFEE)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

Coffee Price Financial Market

The coffee market is an essential segment of the global soft commodities market, known for its extensive trade on exchanges such as the Intercontinental Exchange (ICE). Coffee is categorized as a "soft commodity," and its futures contracts are vital for hedging, investment, and price forecasting. The trading of coffee futures allows stakeholders, from large multinational corporations to small-scale farmers, to mitigate the risks associated with fluctuating coffee prices.

In the financial realm, coffee prices are influenced by numerous factors, including supply-demand dynamics, political stability in major coffee-producing regions, and global economic conditions. The Coffee price chart offers traders valuable insights, allowing them to identify trends and forecast future price movements based on past data.

For anyone looking to buy Coffee or sell Coffee, understanding these financial nuances is key. Investors often look to coffee futures as part of a diversified commodity portfolio, seeing it as an opportunity to capitalize on price volatility. A well-planned Coffee trading strategy involves not just short-term speculation but also long-term forecasts based on the Coffee price prediction.

The price of coffee, like other agricultural commodities, can experience substantial volatility. For instance, a sudden freeze in Brazil's coffee-growing regions can reduce supply, triggering a spike in prices. Additionally, price movements are often affected by the broader economic landscape, including inflation rates and fluctuations in currency exchange. Traders often turn to a Coffee price calculator to determine entry and exit points in these volatile markets.

Overview of Current Coffee Price Trends

As of December 2024, coffee prices have experienced significant fluctuations due to both supply-side and demand-side factors. The price of coffee futures, specifically the Arabica coffee futures, has been trading at approximately $1.55 per pound, reflecting a reduction from previous highs, which saw prices surge above $2 per pound. This price spike was largely driven by adverse weather conditions in Brazil, the world’s largest coffee exporter, and political instability in key producing nations.

The current coffee price trends reveal that the market is somewhat recovering from the highs of the last few years. However, it remains sensitive to ongoing disruptions. According to Barchart, this volatility can be traced to both cyclical factors (such as harvest periods) and the long-term shifts in consumption habits. The rise of specialty coffee and the increasing demand for organic and ethically sourced beans are reshaping the market. Consumers are increasingly willing to pay a premium for these products, driving a steady rise in prices across premium and niche segments of the market.

At the same time, the pandemic's aftereffects have resulted in significant shifts in how coffee is consumed, with many consumers now opting for at-home brewing instead of café purchases, affecting the demand dynamics. As we head into 2025, experts anticipate a slight decline in prices as the market stabilizes, with demand and supply reaching a balance post-pandemic.

Current Coffee Market Trends

Coffee is more than just a daily beverage; it’s a $20 billion industry in the U.S. alone, according to market analysis from Expert Market Research. The sector is expected to grow at a compound annual growth rate (CAGR) of 3.99% through 2032. This growth can be attributed to the increasing preference for premium and specialty coffees, as well as innovations in coffee preparation such as single-serve pods and more advanced brewing systems.

The trend towards sustainable coffee production is also reshaping the market. Consumers are becoming more conscious of the environmental and social impacts of their purchases, leading to a rise in demand for Fair Trade and Rainforest Alliance-certified coffee. These certifications ensure that farmers receive fair compensation for their work and that the coffee is produced using environmentally responsible methods. As a result, brands are increasingly offering ethically sourced coffee, which often comes at a higher price point. This is creating new market dynamics, where coffee's price is not solely driven by supply and demand but also by the sustainability narrative.

Another significant trend is the growth of coffee pods and ready-to-drink coffee beverages. The convenience factor has led to a surge in demand for these products, particularly in the U.S. and Europe. Companies like Keurig, Nespresso, and Starbucks have capitalized on this trend, driving their revenues through innovative coffee consumption solutions.

The shift towards at-home coffee brewing is also notable. During the pandemic, many coffee drinkers turned to home coffee machines, a trend that is expected to persist. Consumers are now more knowledgeable about the different types of coffee beans, their flavor profiles, and how to brew the perfect cup at home.

Factors Affecting Coffee Price and the Coffee Market

Coffee prices are influenced by various factors, from climate change to market speculation. Understanding these factors is crucial for anyone involved in coffee trading or for consumers who wish to understand the pricing structure.

Weather Conditions and Climate Change

Coffee is highly sensitive to weather, particularly during the flowering and harvesting stages. Brazil, which produces approximately one-third of the world’s coffee, is particularly susceptible to adverse weather events like frosts, droughts, and heavy rains. A freeze in Brazil's coffee-growing regions can devastate crops, causing a spike in prices, as seen in 2021. As climate change intensifies, coffee production may become even more unpredictable, further contributing to price volatility.

Currency Movements

Since coffee is traded in U.S. dollars, fluctuations in the value of the dollar can significantly affect prices. A strong dollar makes coffee more expensive for international buyers, potentially reducing demand from overseas. Conversely, a weak dollar can make coffee more affordable for foreign markets, boosting demand.

Supply Chain Disruptions

Coffee's complex supply chain, which spans continents, is prone to disruptions. These can occur due to transportation issues, labor strikes, or political instability in coffee-producing countries. Any disruption in the supply chain can lead to a shortage of coffee beans, driving up prices.

Consumer Trends

Consumer preferences also play a pivotal role in determining coffee prices. The increasing demand for organic, Fair Trade, and specialty coffees has pushed premium prices higher. Furthermore, trends like the rise of cold brew coffee and nitro coffee have created new markets that impact the overall demand for different coffee products.

Speculation and Futures Trading

Coffee futures are often traded as a speculative investment, with hedge funds and commodity traders buying and selling based on anticipated price movements. This speculation can amplify price fluctuations, sometimes leading to price bubbles. Traders use Coffee price charts to analyze historical trends and make predictions, but these forecasts are highly dependent on geopolitical events, economic forecasts, and crop reports.

Other Related Soft Commodities Affected by Coffee Price Action

The price action of coffee has implications beyond just the coffee market. Coffee is intertwined with other agricultural commodities, particularly those classified under "softs," such as cocoa and sugar. Adverse weather conditions that impact coffee production can also affect these other commodities, especially if farmers in key growing regions have to divert resources or reduce crop sizes.

For instance, Brazil’s coffee-producing areas are also key suppliers of sugar and cocoa. When coffee prices spike due to a poor harvest, it often has a ripple effect on the prices of other soft commodities. Similarly, coffee prices can be influenced by broader economic factors, such as the price of oil, which impacts transportation costs and, in turn, the cost of shipping coffee beans from producing countries to consumers worldwide.

Moreover, changes in the price of coffee can influence global food and beverage companies. For instance, large companies like Nestlé and Starbucks are directly impacted by fluctuations in the price of coffee beans, as they must adjust their pricing strategies to maintain profit margins. These adjustments can have a knock-on effect on related commodities like milk, sugar, and even packaging materials.

Conclusion

The coffee market is a dynamic and complex sector driven by a wide array of factors, from climatic events and currency movements to consumer trends and speculative trading. As a globally traded commodity, coffee prices can fluctuate significantly, impacting both producers and consumers. Understanding the forces that shape coffee prices, such as weather patterns, market trends, and economic conditions, is essential for anyone involved in the coffee industry, whether they are buying Coffee for personal consumption, trading futures, or operating a coffee business.

The rise in demand for sustainable and specialty coffee, coupled with innovations in coffee consumption, is transforming the coffee market. As we look toward the future, these trends, combined with ongoing challenges like climate change, will likely continue to shape coffee prices and market dynamics for years to come.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

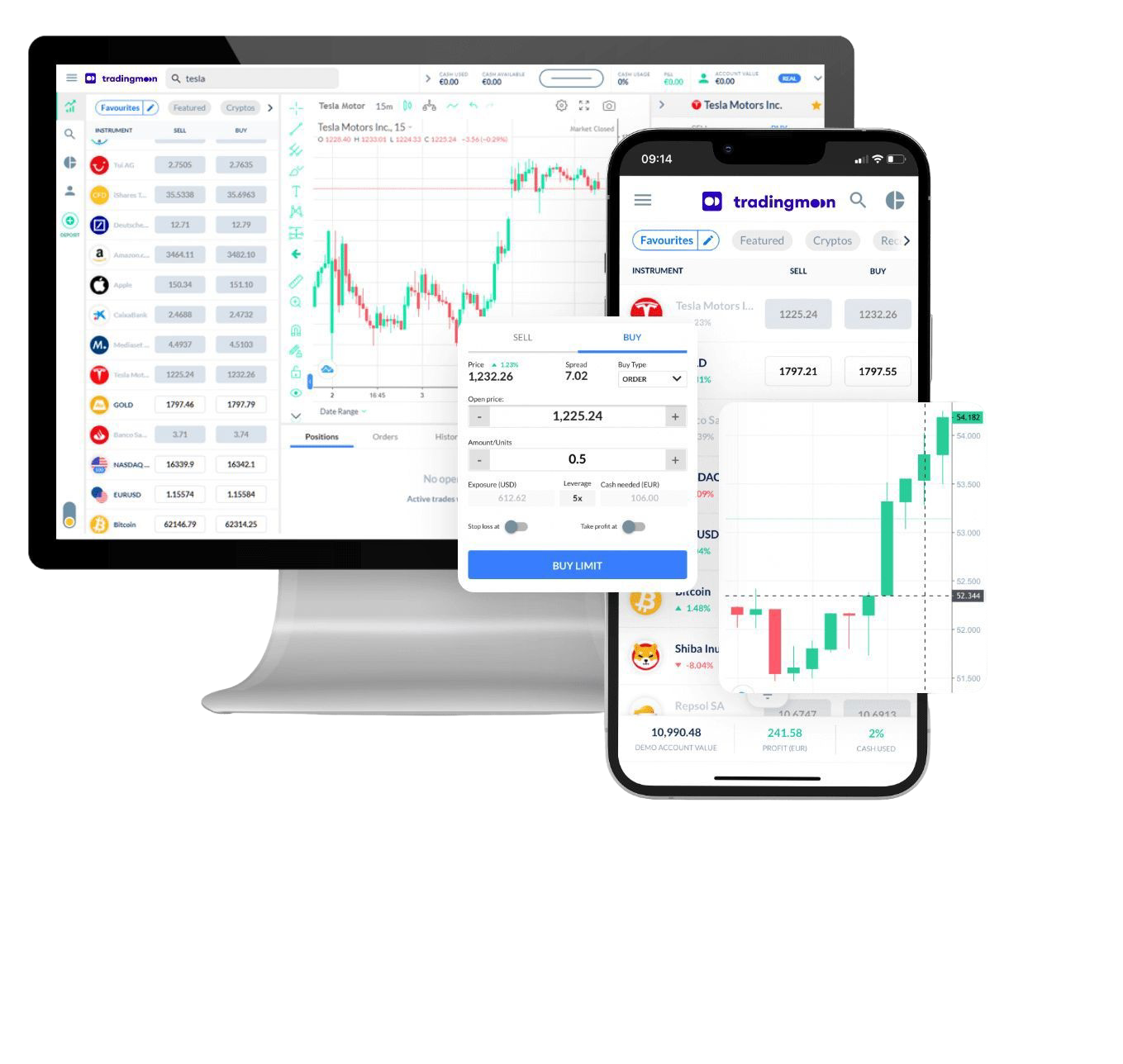

Trade [[data.name]] with TradingMoon

Take a view on the commodity sector! Diversify with a single position.

- Trade 24/5

- Tight spreads

- Average Execution at 5ms

- Easy to use platform

FAQs

What are the risks associated with coffee commodity trading?

+ -

The risks associated with coffee commodity trading are diverse and could impact various stakeholders in the industry. Price volatility is a significant risk, as coffee prices could fluctuate greatly due to factors such as weather conditions, supply and demand imbalances, and geopolitical events. These price fluctuations could affect profitability for traders, roasters, and producers alike.

Additionally, currency fluctuations could pose risks, especially for international trading. Political instability in producing regions could disrupt supply chains and impact prices. Climate change is another concern, as it may affect its production and quality. Market speculation and manipulation also introduce risks. To mitigate these risks, participants in the commodity trading employ risk management strategies such as hedging, diversification, and staying informed about market dynamics.

What are the advantages and disadvantages of trading coffee CFDs?

+ -

Trading coffee CFDs offers advantages such as leverage, flexibility, global market access, and the ability to profit from rising and falling prices. With leverage, traders can control larger positions with smaller capital, potentially increasing profits. Coffee CFDs can be bought or sold at any time during market hours, allowing traders to quickly react to price movements and news events.

Traders can go long or short, expanding their opportunities. CFD platforms, like TradingMoon, provide risk management tools such as stop-loss orders to manage potential losses. However, it's important to consider the potential disadvantages, including the risk of magnified losses, market volatility, and associated trading costs. Careful considerations are recommended before engaging in CFD trading.

Are there any seasonal patterns in coffee price trading?

+ -

Yes, there are seasonal patterns in coffee price trading. Its price may be influenced by factors such as harvest seasons and weather conditions in coffee-producing regions. Historical data analysis and market observations have revealed recurring patterns in coffee price movements throughout the year. For example, during the harvest season, when there is an abundant supply of coffee beans, prices may decline due to increased availability. Conversely, during periods of adverse weather conditions or potential crop diseases, prices may rise as concerns over reduced supply emerge.

Traders often take advantage of these seasonal patterns by implementing strategies based on historical trends to anticipate and capitalize on price fluctuations in the market.

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without the restrictions that come with owning the underlying asset.

CFD

Actual Commodities

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Trade on volatility

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels