Loading...

Aluminium: Live Price Chart

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

Aluminium Price Summary

Aluminium Price Summary

Aluminium Price Market Overview: Drivers, Trading Strategies, and Related Commodities

Aluminium, the versatile metal known for its lightweight, corrosion-resistant, and recyclable properties, plays a crucial role in various industries, ranging from construction and automotive to packaging and aerospace. Understanding the dynamics of the aluminium price market is crucial for both businesses reliant on the metal and investors seeking to capitalize on its price fluctuations. This is a comprehensive overview of the aluminium market, covering key aspects like price drivers, trading strategies, and its correlation with other significant commodities.

The aluminium price market is a global ecosystem with a complex interplay of supply, demand, geopolitical factors, and technological advancements. China stands as the world's largest producer and consumer of aluminium, exerting significant influence on global prices. Other major players include Russia, Canada, and India.

Demand for aluminium is primarily driven by the construction and transportation sectors. As nations invest in infrastructure development and the global demand for automobiles, aircraft, and ships increases, the need for aluminium will likely rise. Furthermore, the growing popularity of electric vehicles, which utilize aluminium extensively to offset battery weight, is poised to further propel demand in the coming years.

On the supply side, aluminium production is energy-intensive, making the cost of electricity a key factor influencing profitability and production levels. Therefore, fluctuations in energy prices, particularly those of coal and natural gas, can significantly impact aluminium prices. Additionally, geopolitical events such as trade wars, sanctions, and environmental regulations can disrupt supply chains and contribute to price volatility.

Aluminium Price: Factors Influencing Price Fluctuations

Understanding the aluminium market requires unraveling the complex interplay of supply, demand, and macroeconomic factors that shape its price.

Supply Dynamics:

- Production Costs: Energy, particularly electricity, constitutes a significant portion of aluminium production costs. Fluctuations in energy prices, especially those of coal and natural gas, directly impact aluminium prices.

- Bauxite Ore Availability : Bauxite, the primary source of aluminium, experiences price swings due to geopolitical factors, mining regulations, and supply chain disruptions. China's Influence : As the world's largest producer and consumer of aluminium, China's production levels and inventory management significantly influence global supply and price trends.

Demand Determinants:

- Global Economic Growth: Robust economic growth, particularly in emerging markets, fuels demand for aluminium in construction, infrastructure development, and manufacturing sectors.

- Automotive Industry Trends : The automotive industry, with its increasing adoption of lightweight aluminium components for fuel efficiency, remains a major driver of aluminium demand.

- Packaging Sector: The packaging sector's consistent demand for aluminium cans and foils contributes to the metal's overall consumption.

Macroeconomic Factors:

- Currency Fluctuations : As aluminium is traded globally in US dollars, fluctuations in exchange rates impact its price in local currencies, influencing both import and export dynamics.

- Interest Rates : Interest rate changes affect borrowing costs for manufacturers and investors, potentially influencing aluminium inventory levels and price volatility.

- Geopolitical Events : Trade wars, sanctions, and political instability can disrupt global supply chains, creating price volatility in the aluminium market.

Entering the Aluminium Market: Buying and Selling Aluminium

Investors and businesses alike participate in the aluminium market through various avenues, each offering distinct advantages and considerations:

Buying aluminium:

- Physical aluminium : Purchasing physical aluminium, whether in ingot, billet, or other forms, provides tangible ownership but necessitates storage and transportation considerations.

- Aluminium Futures Contracts : These contracts, traded on commodity exchanges, allow investors to speculate on future aluminium prices or hedge against potential price risks.

- Aluminium ETFs : Exchange-traded funds (ETFs) that track the price of aluminium offer investors exposure to the metal without the complexities of physical ownership.

Selling aluminium:

- Physical Sales : Producers and businesses holding physical aluminium can sell their inventory through spot market transactions or long-term contracts.

- Futures Market Short Selling : Traders anticipating a price decline can sell aluminium futures contracts, aiming to profit from the price difference when repurchasing them at a lower price.

- Options Trading : Options contracts provide the right, but not the obligation, to sell aluminium at a predetermined price within a specific timeframe, offering flexibility in managing price risk.

Aluminium Market History

The history of the aluminium market is marked by significant milestones:

- Early Discovery and High Value : Initially, aluminium was considered a precious metal due to the complexity of extracting it from bauxite. In the 19th century, it was even more valuable than gold.

- The Hall-Héroult Process : The invention of the Hall-Héroult process in the late 19th century revolutionized aluminium production, making it significantly cheaper and more accessible.

- 20th Century Growth : The 20th century saw a surge in aluminium demand, driven by its use in transportation, construction, and packaging.

- The Rise of Recycling : The energy-intensive nature of primary aluminium production led to the rapid growth of aluminium recycling, which now accounts for a significant portion of the global supply.

- Present and Future Trends : Today, the aluminium market faces challenges like volatile energy prices and geopolitical uncertainties. However, the metal's lightweight, durable, and recyclable nature positions it well for future growth, particularly in electric vehicle manufacturing and renewable energy technologies.

Trading Aluminium:

The aluminium market offers various avenues for trading and investment:

- Futures Contracts : Traded on exchanges like the LME, futures contracts allow participants to buy or sell a predetermined quantity of aluminium at a specific price and future date.

- Options Contracts : Options provide the right, but not the obligation, to buy or sell aluminium at a specified price within a set timeframe.

- Exchange-Traded Funds (ETFs): ETFs track the performance of the aluminium market, offering investors exposure to aluminium prices without directly owning physical aluminium.

- Physical aluminium : Industrial consumers often purchase physical aluminium directly from producers or through intermediaries.

Important Considerations for Aluminium Trading:

- Market Volatility : The aluminium market is susceptible to significant price swings due to the factors discussed earlier. Traders and investors must understand and manage this volatility effectively.

- Geopolitical Risks : Disruptions to global supply chains or changes in trade policies can significantly impact aluminium prices.

- Currency Fluctuations : As aluminium is priced in US dollars, traders need to be mindful of currency exchange rate movements.

- Fundamental Analysis : Evaluating supply and demand factors, global economic indicators, and geopolitical events provides insights into potential price trends.

- Technical Analysis : Utilizing chart patterns, indicators, and oscillators can help identify entry and exit points based on historical price movements.

- Risk Management : Employing stop-loss orders, position sizing, and diversification strategies are crucial for mitigating potential losses and preserving capital.

Navigating the complexities of the aluminium market requires a comprehensive understanding of its inherent dynamics, influencing factors, and interconnectivity with the broader commodity landscape. By combining fundamental and technical analysis, implementing effective risk management strategies, and staying informed about global economic trends, investors and businesses can position themselves for success in this dynamic and ever-evolving market.

Aluminium Price and its Correlation with Key Commodities:

The price of aluminum is intrinsically linked to the prices of other commodities, reflecting interdependencies within the global economy.

- Gold price (XAUUSD) : As a precious metal often considered a safe haven asset, gold tends to have a low or even negative correlation with aluminium. During periods of economic uncertainty, investors may flock to gold, pushing its price up while aluminium, viewed as a riskier asset, may decline.

- Silver price : Silver, with its dual role as a precious metal and an industrial metal, often displays a positive correlation with aluminium.

- Brent Crude price and WTI Crude Oil price: Aluminium production is energy-intensive, so rising oil prices can increase production costs and potentially impact aluminium prices. Therefore, a moderate positive correlation exists.

- Natural Gas price : Similar to oil, natural gas is a key energy source for aluminium smelters. A positive correlation exists between natural gas prices and aluminium prices.

- Palladium price and Platinum price : While both palladium and platinum are precious metals, they also have significant industrial applications, particularly in the automotive industry. Consequently, their prices often show a moderate positive correlation with aluminium.

- Zinc price , Nickel price, Copper price: These base metals often show a strong positive correlation with aluminium, as they are used in similar industrial applications and are influenced by similar economic factors.

- Carbon Emissions price: The aluminium industry is a significant emitter of greenhouse gases. Consequently, higher carbon emission prices, often implemented through cap-and-trade systems, can increase aluminium production costs and impact prices.

- USD (US Dollar) : As mentioned earlier, a weaker US dollar tends to strengthen aluminium prices due to increased affordability for buyers using other currencies. A negative correlation usually exists between the USD and aluminium prices.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

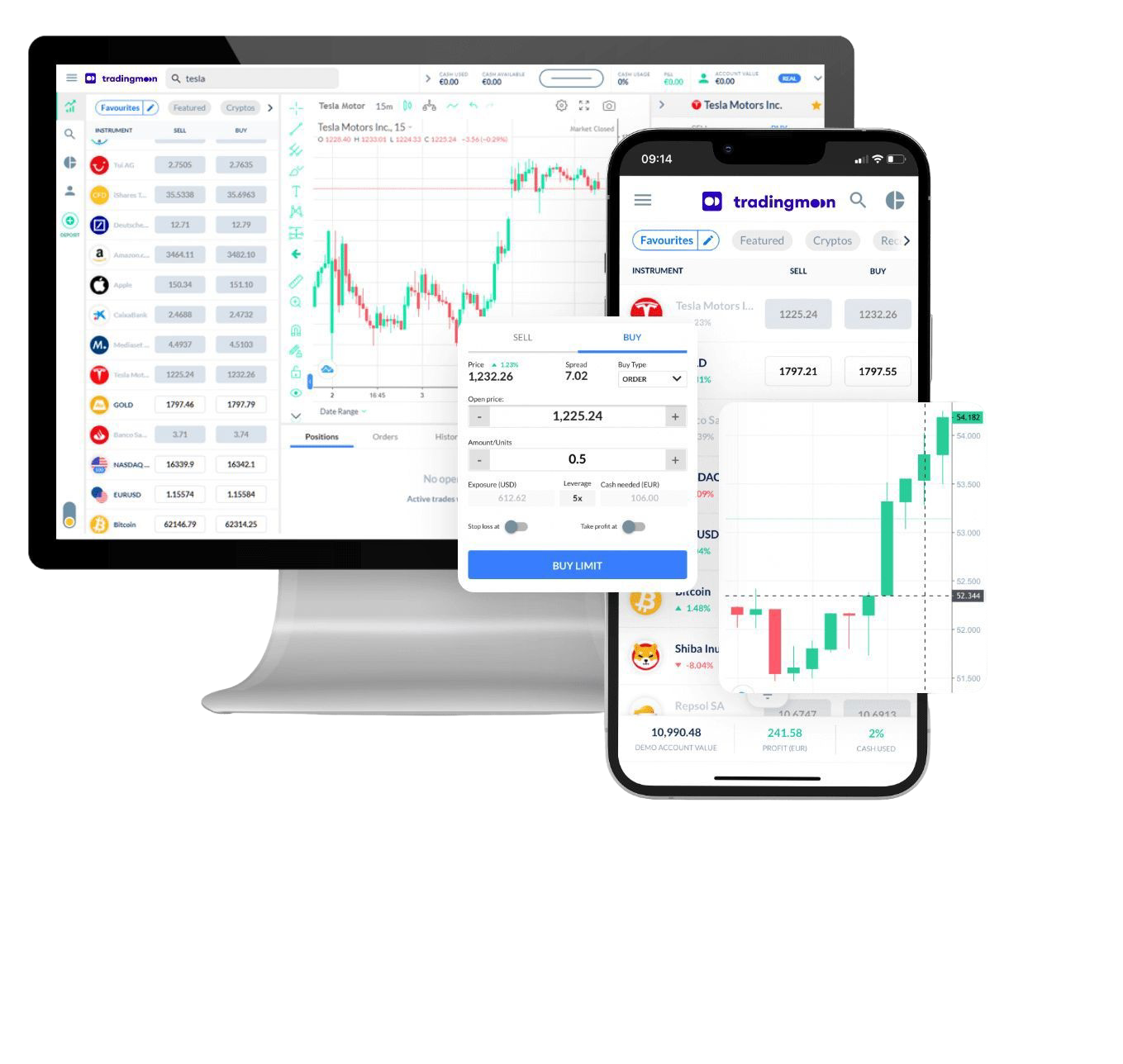

Trade [[data.name]] with TradingMoon

Take a view on the commodity sector! Diversify with a single position.

- Trade 24/5

- Tight spreads

- Average Execution at 5ms

- Easy to use platform

FAQs

How does trading aluminium CFDs work?

+ -

Trading aluminium CFDs involves speculating on the price movements of aluminium without owning the physical metal. A CFD (contract for difference) is a derivative instrument that allows traders to profit from the difference in the price of aluminium between the opening and closing of the trade.

Traders could go long (buy) if they anticipate the price will rise or go short (sell) if they believe it will fall. When trading aluminium CFDs, traders enter into a contract with a broker and make a profit or loss based on the difference between the entry and exit prices. It's important to note that CFD trading carries risks, including the potential for losses exceeding the initial investment.

What factors affect the price of Aluminium?

+ -

Several factors could impact the price of aluminium. Firstly, global supply and demand dynamics play a crucial role. If the demand for aluminium exceeds the available supply, prices tend to rise, and vice versa. Economic conditions, such as GDP growth, industrial production, and construction activity, also influence the prices. Additionally, geopolitical events like trade disputes or political instability could affect prices by disrupting supply chains or imposing tariffs.

Energy costs are also significant as aluminium production requires substantial energy inputs. Currency exchange rates also play a role since aluminium is priced in USD, fluctuations in currencies could impact its cost. Lastly, government policies and regulations regarding production, trade, or environmental standards could influence its prices.

How do I analyze the trend of aluminium prices?

+ -

To analyze the trend of aluminium prices, several factors should be considered. Firstly, historical price data may be examined using charts and graphs to identify patterns and trends over time. Technical analysis tools such as moving averages, support and resistance levels, and momentum indicators could also help identify potential price movements.

Additionally, staying informed about market news, industry reports, and forecasts from reputable sources could provide valuable insights into supply and demand dynamics and macroeconomic factors affecting its prices. It's important to consider both fundamental analysis, which examines factors like global economic conditions and industry trends, and technical analysis when analyzing the trend of the prices.

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without the restrictions that come with owning the underlying asset.

CFD

Actual Commodities

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Trade on volatility

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels