Loading...

Axie Infinity (AXSUSD)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

Axie Infinity Price and the Financial Market

Axie Infinity, a popular blockchain-based game, has gained significant traction in the cryptocurrency and NFT space since its inception in 2018. Its in-game currency, Axie Infinity Shards (AXS), plays a key role in the broader financial market by influencing the play-to-earn (P2E) ecosystem and showcasing how gaming can intersect with finance. Axie Infinity’s price is driven not only by its gameplay mechanics but also by the broader acceptance of NFTs, blockchain technology, and decentralized finance (DeFi).

In recent years, the Axie Infinity price has fluctuated due to changes in demand for the game, overall market sentiment toward cryptocurrencies, and macroeconomic factors affecting risk assets. With a market cap of $1.45 billion as of December 2024, the Axie Infinity price has seen periods of explosive growth—peaking at $165.93 during the height of its popularity in 2021—followed by corrections as investor sentiment shifted. Despite this, Axie Infinity remains one of the most significant and well-known blockchain games.

The game's popularity during the pandemic highlighted the potential for virtual economies, especially in developing countries. This shift towards digital assets and blockchain-based games has led to higher visibility for Axie Infinity, impacting its price fluctuations and drawing attention from both retail and institutional investors.

Overview of Current Axie Infinity Price Trends

As of December 3, 2024, the price of Axie Infinity (AXS) is $9.42, showing a 22.45% increase in the past 24 hours. This follows a broader trend of recovery from its lows earlier in the year. Throughout November 2024, the price surged over 100%, from $4.44 at the beginning of the month to its current value.

Axie Infinity’s price often reflects investor interest, gameplay updates, and overall market sentiment toward NFTs and cryptocurrencies. For instance, the game's significant price jumps during periods of heightened interest in play-to-earn games mirror trends seen in other blockchain projects, where community engagement and adoption lead to price rallies.

Market Forces Driving Axie Infinity Price Trends

The Axie Infinity price is deeply influenced by various factors:

- Player Activity : Axie Infinity’s price tends to rise when active players increase, especially during major game updates or new features, such as the introduction of new breeding mechanics or in-game tokens.

- Tokenomics : The supply and demand dynamics of Axie Infinity’s native token, AXS, directly affect its price. With a circulating supply of 155 million AXS tokens, scarcity or abundance can shift market sentiment.

- Cryptocurrency Market Trends : As part of the broader crypto ecosystem, Axie Infinity’s price often correlates with the movements of Bitcoin and Ethereum, which can drive its volatility.

- Investor Sentiment : Market cycles—especially in the crypto space—play a significant role in the price of AXS. During bullish periods, the price can increase as speculators and gamers rush to buy Axie Infinity, while bearish trends can lead to a decline in value.

Current Axie Infinity Price Market Trends

The Axie Infinity price is currently witnessing positive market trends, with a strong rebound since late 2024. This shift is largely driven by an increase in adoption within the gaming community, as well as a renewed interest in NFTs and blockchain gaming. As the price of AXS increases, it also attracts more liquidity into the Axie Infinity ecosystem, fueling further growth. Additionally, Axie Infinity’s ability to innovate, such as integrating with other decentralized platforms and scaling its ecosystem, contributes to a more resilient market position.

Moreover, the ongoing development of Axie Infinity’s governance system and community-driven features plays a crucial role in sustaining long-term price stability. By allowing players to stake AXS tokens and participate in governance decisions, the platform fosters deeper engagement, which helps stabilize the price and create a loyal user base.

Factors Affecting Axie Infinity Price and Market

Several key factors can influence the price of Axie Infinity and the broader Axie Infinity market:

Supply and Demand for Axies : The in-game digital pets (Axies) are bought, sold, and bred using AXS and other tokens. Fluctuations in demand for Axies—driven by changes in player interest, breeding mechanics, or game updates—directly impact AXS’s price.

Game Mechanics and Updates : New game updates, changes to the in-game economy, and the introduction of new Axie classes or features can alter player engagement and investment, which in turn affects AXS price. For instance, significant changes to the game's play-to-earn model or reward structures can result in price volatility.

Market Liquidity : The liquidity of AXS on exchanges, including high trading volumes on platforms like Binance and Coinbase, influences price stability. When liquidity is high, it generally leads to more efficient price discovery and less volatility.

Regulatory Environment : Global regulatory developments surrounding cryptocurrencies, NFTs, and blockchain gaming could have a significant impact on Axie Infinity’s price. Uncertainty about government policies or new regulations can create price swings.

Economic and Market Conditions : Broader economic trends, including inflation rates, interest rates, and investor appetite for risk, can affect the performance of cryptocurrencies, including AXS. When traditional financial markets face downturns, digital assets like Axie Infinity can experience price drops as investors seek safer assets.

Other Related Cryptocurrencies Affected by the Price Action of Axie Infinity

The price action of Axie Infinity (AXS), a prominent play-to-earn (P2E) game token, can significantly impact other cryptocurrencies, especially those in the gaming, metaverse, and NFT sectors. Many projects related to these spaces share a common audience and technological foundations, meaning that price fluctuations in Axie Infinity often ripple through the broader ecosystem.

Smooth Love Potion (SLP) : This is another token associated with Axie Infinity, used as an in-game reward. AXS price movements often influence SLP, as both are integral to the game's economy. A surge or decline in AXS can drive similar price behavior in SLP.

Decentraland (MANA) and The Sandbox (SAND) : As metaverse platforms where users can engage in virtual experiences and earn rewards, their price action is often correlated with Axie Infinity's, as both represent the broader gaming and NFT trend. AXS's performance can reflect broader interest in the P2E and metaverse spaces.

Enjin Coin (ENJ) : Enjin provides a platform for creating and managing NFTs, a key component of Axie Infinity's gameplay. As AXS experiences price volatility, ENJ could also see price changes due to its connection to the NFT and gaming sectors.

In summary, Axie Infinity's price movements influence other cryptocurrencies involved in gaming, metaverse development, and NFTs due to shared market trends and user bases.

Conclusion

Understanding Axie Infinity’s price movements requires a deep dive into its tokenomics, gameplay dynamics, and market conditions. Players and investors looking to buy Axie Infinity or sell Axie Infinity need to consider not only the current price trends but also the broader factors shaping the game’s ecosystem. With continued innovation, market growth, and stable governance, Axie Infinity’s price could continue to show resilience in the volatile world of blockchain gaming.

For accurate price tracking, tools like the Axie Infinity price calculator and Axie Infinity chart are essential for making informed decisions. Additionally, considering an Axie Infinity trading strategy can help navigate the market’s volatility while managing risks.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

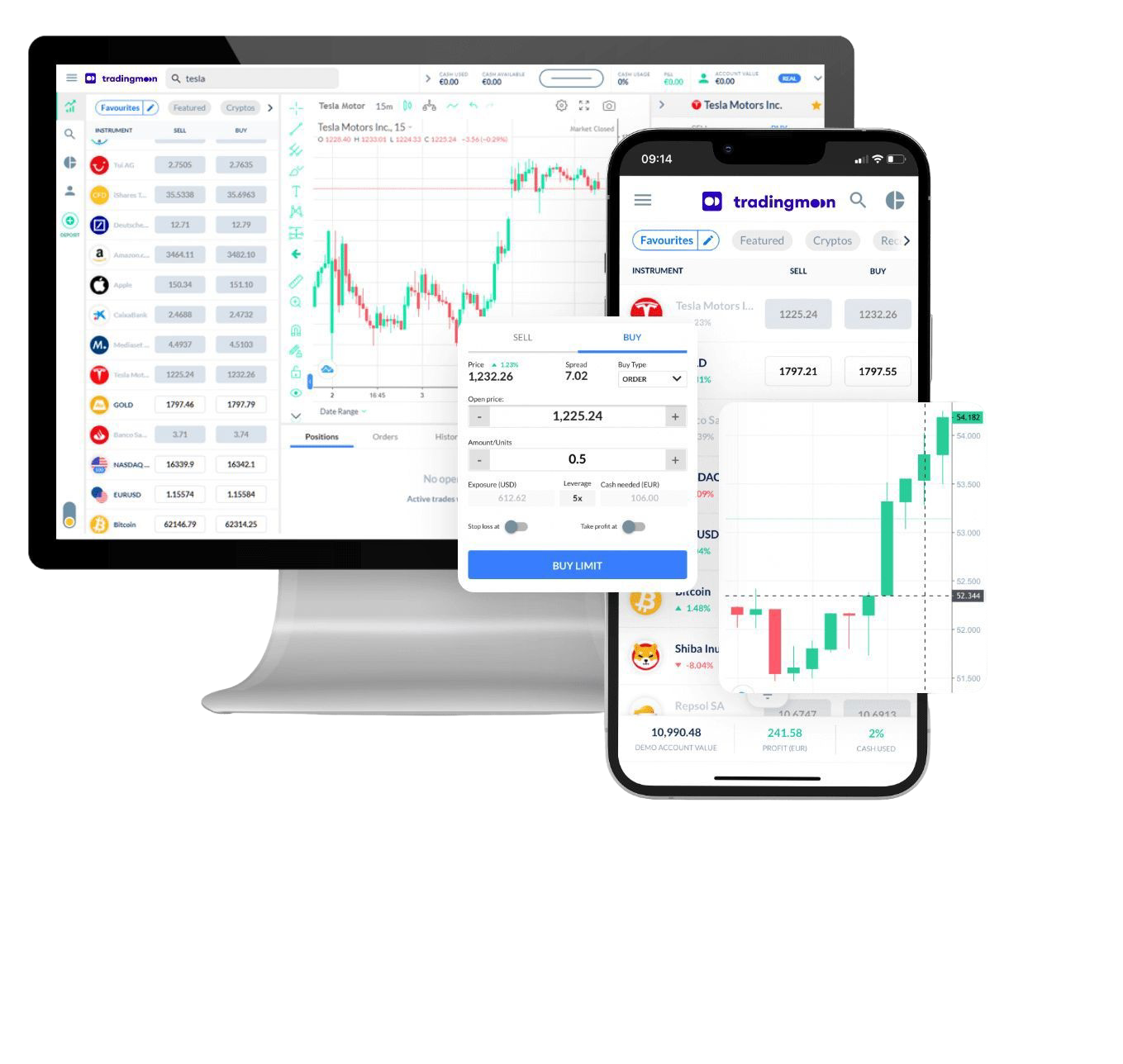

Trade [[data.name]] with TradingMoon

The most popular and trending cryptocurrencies, all in one place at the right time.

- Trade 24/7

- Minimum margin requirement below ~3$

- Spreads of just $0.50 on BTC - lower on other crypto! Plus a super low trading fee of 0.1%/side

- No withdrawal fees

- Diversify! 900+ instruments to choose from

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying crypto asset.

Crypto CFD

Physical Crypto

Capitalise on rising stock prices (go long)

Capitalise on falling crypto prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset or have an exchange account

No exchange fees or complex storage costs

Just lower commissions in the form of spreads and a small taker-fee

Manage risk with in-platform tools

Ability to set take profit and stop loss levels