Loading...

BTC to GBP (BTCGBP)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

Bitcoin GBP Price: Financial Market Insights

The exchange rate of Bitcoin (BTC) to the British pound (GBP) has become an important metric for investors and financial analysts alike. As Bitcoin solidifies its place in the financial ecosystem, its value relative to traditional currencies like GBP provides insights into both cryptocurrency markets and broader economic trends. This comprehensive analysis delves into Bitcoin GBP trends, influencing factors, market dynamics, and the broader impact on commodities.

Overview: Current Bitcoin GBP Price Trends

Bitcoin, the world's first cryptocurrency, has seen its value against GBP fluctuate significantly in 2024. Currently, Bitcoin's price against the GBP sits at approximately £47,693, reflecting a mix of short-term corrections and long-term bullish trends. Over the past year, Bitcoin has seen lows near £19,750 and highs surpassing £57,537, a testament to its inherent volatility.

This year’s trends have been influenced by macroeconomic uncertainties, including the Bank of England's monetary policies, geopolitical events like the conflict in Eastern Europe, and continued adoption of cryptocurrencies by institutional investors. Bitcoin's reputation as a store of value continues to grow, rivaling traditional safe-haven assets like gold and silver.

The UK, being one of the most prominent financial hubs globally, plays a vital role in the Bitcoin market. The evolving stance of the Financial Conduct Authority (FCA) on cryptocurrency regulations has also impacted trading volumes and investor sentiment in the region.

Current Bitcoin GBP Price Market Trends

Bitcoin GBP prices are shaped by a blend of global market forces and local financial developments. A key observation in 2024 is the correlation between Bitcoin and traditional financial markets, particularly in times of high inflation or economic uncertainty.

Institutional Involvement

Major institutional players have increasingly allocated resources to Bitcoin as a part of their portfolios. This growing interest has introduced a degree of price stability compared to earlier years, although Bitcoin's inherent volatility remains significant.

Retail Trading Boom

Retail interest in cryptocurrencies remains high in the UK. Platforms like Binance, Coinbase, and Kraken have reported robust trading activity, with many users leveraging advanced tools like real-time Bitcoin GBP charts and price calculators to refine their strategies.

Technology's Role

Advancements in blockchain technology have bolstered Bitcoin’s appeal, particularly upgrades to transaction speed and scalability. Innovations in DeFi (Decentralized Finance) and interoperability between Bitcoin and other blockchain networks have also spurred its adoption.

Factors Affecting Bitcoin GBP Price and the Bitcoin GBP Market

1. Macroeconomic Indicators

Bitcoin’s price in GBP is heavily influenced by global and UK-specific economic conditions:

- Interest Rates: The Bank of England’s decisions on interest rates directly impact the GBP's strength, indirectly affecting Bitcoin's exchange rate.

- Inflation Rates: Rising inflation has historically pushed investors towards assets like Bitcoin, which is perceived as a hedge against currency devaluation.

2. Regulatory Developments

- The FCA's regulatory stance on cryptocurrencies has far-reaching implications for Bitcoin GBP markets. Positive signals often result in increased trading activity, while restrictive measures can dampen sentiment.

- Brexit-related financial adjustments have also played a role in shaping the UK's cryptocurrency landscape.

3. Market Sentiment

News cycles heavily influence Bitcoin’s valuation. Positive announcements, such as institutional adoption or ETF approvals, can trigger price surges. Conversely, fears of bans or crackdowns can lead to sharp declines.

4. Supply and Demand

Bitcoin’s fixed supply of 21 million coins creates a scarcity effect, driving demand during periods of high interest. Approximately 19.7 million coins are currently in circulation, leaving little room for new issuance.

Other Related Cryptocurrencies Affected by Bitcoin GBP Price Action

The price action of Bitcoin (BTC) often has a significant impact on other cryptocurrencies, particularly those within the broader cryptocurrency market. When Bitcoin experiences substantial price movements, many altcoins tend to follow suit, either amplifying or dampening the effects. This is due to the dominance of Bitcoin in the market, both in terms of market capitalization and investor sentiment.

For example, when Bitcoin experiences a strong bullish trend, altcoins such as Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) often see an increase in value, driven by the optimism surrounding Bitcoin's performance. Similarly, during Bitcoin’s price downturns, these altcoins may experience similar losses, as investor confidence tends to shift toward Bitcoin or away from the market altogether.

Additionally, the Bitcoin-to-GBP (GBP) exchange rate plays a crucial role in shaping the value of altcoins against the British Pound (GBP). As Bitcoin’s price fluctuates in GBP, other cryptocurrencies that are traded in GBP may also experience correlated price movements. For instance, Ethereum and other altcoins often show similar price trends, especially in volatile market conditions.

Ultimately, the behavior of Bitcoin in relation to GBP sets the tone for broader market sentiment, influencing the price direction of other cryptocurrencies in the process.

Navigating the Bitcoin GBP Market

Bitcoin GBP trading offers immense opportunities but requires a strategic approach. Here are some actionable strategies and tools for navigating this dynamic market:

Bitcoin GBP Trading Strategy

Traders can leverage the following approaches:

- Day Trading: Capitalizing on short-term price movements using tools like real-time charts and technical indicators.

- HODLing: Long-term investment strategies that focus on Bitcoin’s value appreciation over time.

Tools for Analysis

Platforms like Binance, Coinbase, and Investing.com offer advanced features, including:

- Bitcoin GBP Charts: Real-time and historical data for technical analysis.

- Bitcoin GBP Price Calculator: Conversion tools to assess potential returns on investment.

Bitcoin GBP Price Prediction

Long-term predictions for Bitcoin's GBP value suggest continued appreciation, driven by adoption and institutional interest. However, market predictions remain speculative, with risks stemming from regulatory uncertainty and market volatility.

The Broader Implications of Bitcoin GBP Trends

Bitcoin's impact extends beyond cryptocurrency markets, influencing traditional finance and shaping the future of digital currencies. Here are some broader implications:

Adoption of Decentralized Finance

- Bitcoin has paved the way for the rise of DeFi, an ecosystem that enables decentralized financial transactions without intermediaries.

Impact on Traditional Banking

- As Bitcoin adoption grows, traditional financial institutions face pressure to innovate and integrate blockchain solutions.

Environmental Considerations

Bitcoin mining’s environmental impact remains a point of contention, prompting debates about sustainable practices within the industry.

Conclusion

The Bitcoin GBP market reflects the intersection of traditional finance and the digital revolution. Understanding its trends, market dynamics, and influencing factors is crucial for investors aiming to capitalize on its opportunities.

By leveraging advanced tools like Bitcoin GBP charts and price calculators, combined with robust trading strategies, investors can make informed decisions. Whether choosing to buy Bitcoin GBP as a long-term asset or sell Bitcoin GBP for short-term profits, staying attuned to market developments is essential.

Bitcoin’s history as a volatile yet transformative asset underscores its potential to reshape financial landscapes. Its trajectory in the GBP market remains a focal point for investors worldwide.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

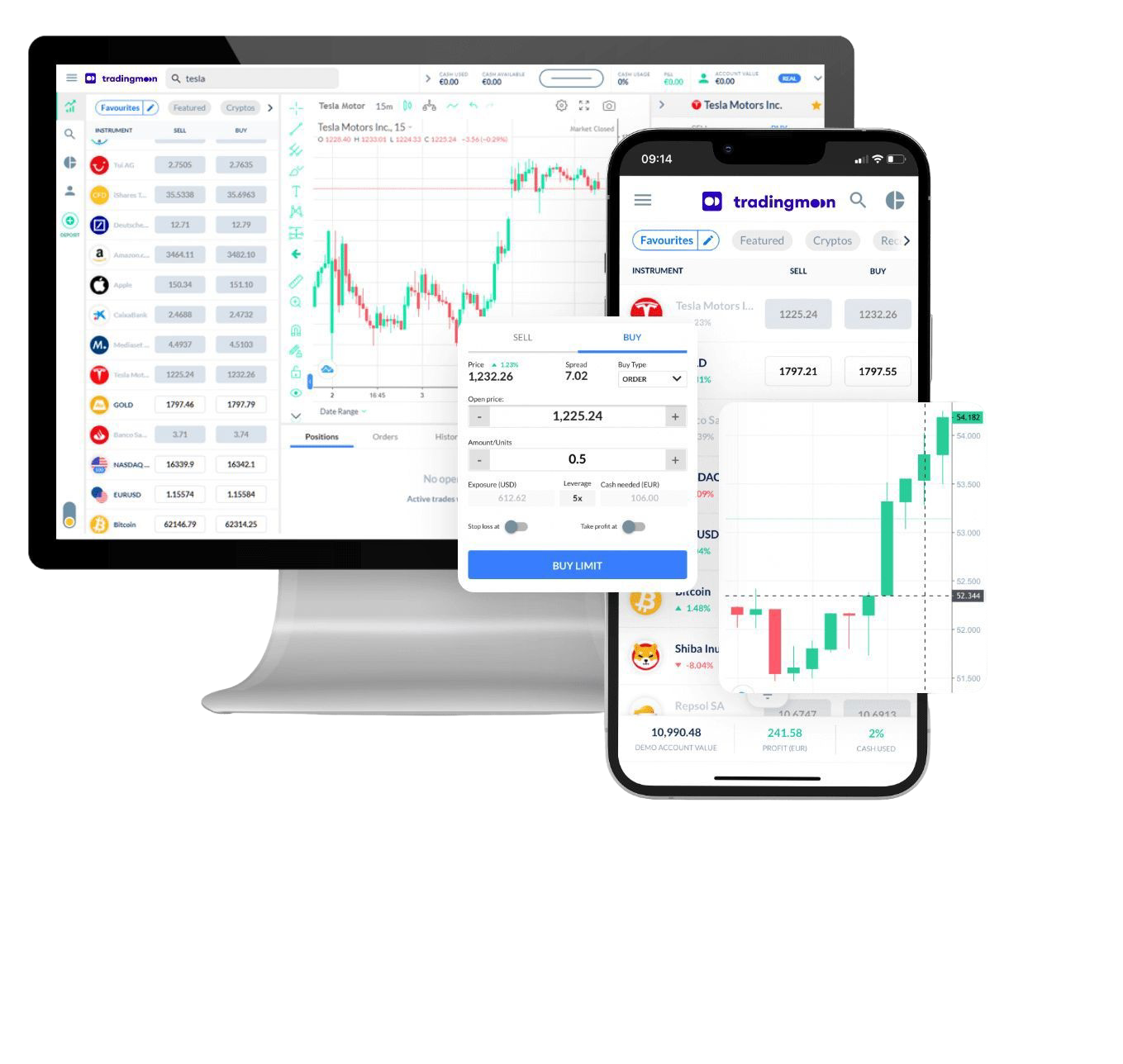

Trade [[data.name]] with TradingMoon

The most popular and trending cryptocurrencies, all in one place at the right time.

- Trade 24/7

- Minimum margin requirement below ~3$

- Spreads of just $0.50 on BTC - lower on other crypto! Plus a super low trading fee of 0.1%/side

- No withdrawal fees

- Diversify! 900+ instruments to choose from

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying crypto asset.

Crypto CFD

Physical Crypto

Capitalise on rising stock prices (go long)

Capitalise on falling crypto prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset or have an exchange account

No exchange fees or complex storage costs

Just lower commissions in the form of spreads and a small taker-fee

Manage risk with in-platform tools

Ability to set take profit and stop loss levels