Loading...

BTC JPY (BTCJPY)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

BTC JPY Price in the Financial Market

Bitcoin (BTC) has transformed global financial markets, offering a decentralized alternative to traditional currencies. The BTC/JPY pair specifically highlights Bitcoin's valuation against the Japanese Yen, reflecting not just global cryptocurrency trends but also regional economic and technological dynamics. Japan, a forerunner in cryptocurrency adoption, maintains a robust infrastructure for crypto trading. This makes the BTC/JPY pair a vital indicator of market behavior and sentiment, particularly in Asia.

Japan’s proactive regulatory stance has encouraged Bitcoin adoption among businesses and individuals. This unique positioning ensures that BTC/JPY price movements often provide early signals for global cryptocurrency trends. Traders frequently use tools like BTC JPY price calculators to gauge investment opportunities, whether they intend to buy BTC/JPY or sell BTC/JPY.

Overview of Current BTC JPY Price Trends

At present, Bitcoin trades around ¥14,024,300, marking a substantial year-over-year increase. While Bitcoin's price is inherently volatile, the BTC/JPY pair showcases distinct trends influenced by Japan's economic policies and the global cryptocurrency market. Over the last year, Bitcoin’s price in yen has risen by 139.75%, driven largely by increasing institutional adoption and a renewed interest in digital assets as a hedge against inflation.

In the past month alone, Bitcoin's value in yen has increased by 37%, highlighting its appeal as an alternative asset amidst uncertainties in global markets. For instance, geopolitical tensions, supply chain disruptions, and inflationary pressures have prompted many investors to diversify their portfolios by including cryptocurrencies. The BTC JPY history further underscores these trends, illustrating the pair's sensitivity to both macroeconomic developments and local monetary policy.

BTC JPY Real-Time Tools

Real-time tracking is essential for trading success. BTC JPY charts and analytics platforms such as TradingView and CoinMarketCap allow traders to identify patterns, track price action, and make informed decisions. These tools are particularly useful for short-term traders implementing scalping or swing trading strategies within the BTC/JPY market.

Current BTC JPY Market Trends

The BTC/JPY market reflects key developments across the cryptocurrency and fiat currency ecosystems. Bitcoin’s dominance in the cryptocurrency market has solidified its role as the benchmark for altcoins, while the Japanese Yen remains a preferred fiat for crypto trading in Asia.

Technical Analysis of BTC JPY

Currently, BTC JPY trading charts indicate a consolidation phase, with Bitcoin prices fluctuating within a defined range. Key resistance levels around ¥14,500,000 could determine whether Bitcoin enters a bullish phase or experiences a short-term correction. Oscillators and moving averages suggest neutral sentiment, providing opportunities for traders to capitalize on market indecision.

For example, BTC JPY trading strategy often involves leveraging Fibonacci retracement levels to identify potential support and resistance points. This strategy is particularly effective in volatile markets, where precise entry and exit points can maximize profits.

Long-Term Projections

Market experts predict that Bitcoin could surpass its all-time high against the yen if bullish trends persist. Factors such as increased institutional investment, technological advancements in blockchain, and Japan’s growing acceptance of cryptocurrencies could drive further growth. On the other hand, traders should remain cautious about potential headwinds, including regulatory changes or macroeconomic shocks.

Factors Affecting BTC JPY Price and the BTC JPY Market

Bitcoin’s value against the yen is influenced by a confluence of factors, ranging from global economic trends to localized policy decisions. Understanding these factors is essential for anyone looking to navigate the BTC/JPY market effectively.

1. Global Bitcoin Demand

Bitcoin’s role as a decentralized digital currency has cemented its status as a hedge against inflation and a store of value. As global demand increases, its price relative to the yen also rises. Notably, Bitcoin's recent adoption as legal tender in some countries and the rising popularity of blockchain-based applications have bolstered its demand.

2. Japanese Economic Policy

The Bank of Japan’s monetary policy, particularly its ultra-loose stance, significantly impacts the yen’s valuation. A weaker yen often leads to higher BTC/JPY prices, as Bitcoin becomes a more attractive investment compared to traditional assets.

3. Technology and Innovation

Japan's technological advancements in blockchain and cryptocurrency exchanges have fostered a thriving ecosystem for BTC/JPY trading. Innovations such as faster payment networks and improved security protocols have enhanced Bitcoin’s appeal to Japanese investors.

4. Market Sentiment and Speculation

Investor sentiment, often shaped by news and events, can drive short-term volatility in BTC/JPY prices. For instance, announcements regarding regulatory changes, technological upgrades, or major market events often trigger price swings.

5. Regulatory Environment

Japan's regulatory clarity has been a boon for Bitcoin adoption. The Financial Services Agency (FSA) closely monitors cryptocurrency activities, ensuring compliance and fostering trust among investors. However, sudden changes in regulatory policies could introduce uncertainty.

Other Related Cryptocurrencies Affected by BTC JPY Price Action

The price action of Bitcoin (BTC) against the Japanese yen (JPY) often has a ripple effect on the broader cryptocurrency market. Since Bitcoin is the largest and most influential cryptocurrency, its movements frequently set the tone for other digital assets, including altcoins. When BTC/USD or BTC/JPY experiences significant price swings, altcoins tend to follow suit, either in a proportional or exaggerated manner.

For instance, Ethereum (ETH), the second-largest cryptocurrency, is highly correlated with Bitcoin’s price, often moving in tandem with BTC’s fluctuations. Other prominent altcoins like Binance Coin (BNB), Ripple (XRP, and Litecoin (LTC) also tend to be influenced by Bitcoin's movements, experiencing price changes in the same direction during BTC rallies or corrections.

Moreover, smaller altcoins, including DeFi (Decentralized Finance) tokens and NFTs (Non-Fungible Tokens), are also susceptible to BTC price action. These cryptocurrencies often display more volatile movements in response to Bitcoin’s shifts, as market sentiment for BTC can strongly influence investor interest in the broader crypto ecosystem.

In regions with high Bitcoin trading volume, such as Japan, BTC’s price dynamics in JPY pairs can have an even more direct impact on local altcoin markets, highlighting Bitcoin’s role as a barometer for the crypto sector.

Future BTC JPY Price Predictions

Predicting BTC/JPY price movements involves analyzing historical data, technical indicators, and external market conditions. Over the next year, analysts anticipate significant growth, provided Bitcoin continues to gain institutional traction and the yen remains relatively weak. However, potential risks, such as regulatory crackdowns or major market corrections, could pose challenges.

Strategies for BTC JPY Traders

- Scalping : Capitalize on short-term volatility by executing multiple trades within a single day.

- Swing Trading : Leverage medium-term trends, entering and exiting positions based on market momentum.

- Long-Term Holding : Invest in Bitcoin with a long-term perspective, banking on its continued adoption and technological evolution.

Practical Tools for Traders

Tools like BTC JPY price calculators and live trading charts are indispensable for implementing these strategies. By using these resources, traders can make data-driven decisions and optimize their portfolios for maximum returns.

Conclusion

The BTC/JPY market offers a wealth of opportunities for investors and traders alike. By understanding the factors influencing Bitcoin’s value in yen, leveraging advanced trading strategies, and staying updated on market trends, participants can navigate this dynamic market effectively. Whether you’re looking to buy BTC/JPY as a long-term investment or sell BTC/JPY for short-term gains, knowledge is your greatest asset.

Bitcoin’s future in the Japanese market looks promising, driven by favorable regulations, technological advancements, and growing acceptance as a mainstream asset. As the market evolves, staying informed and adaptable will be the keys to success.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

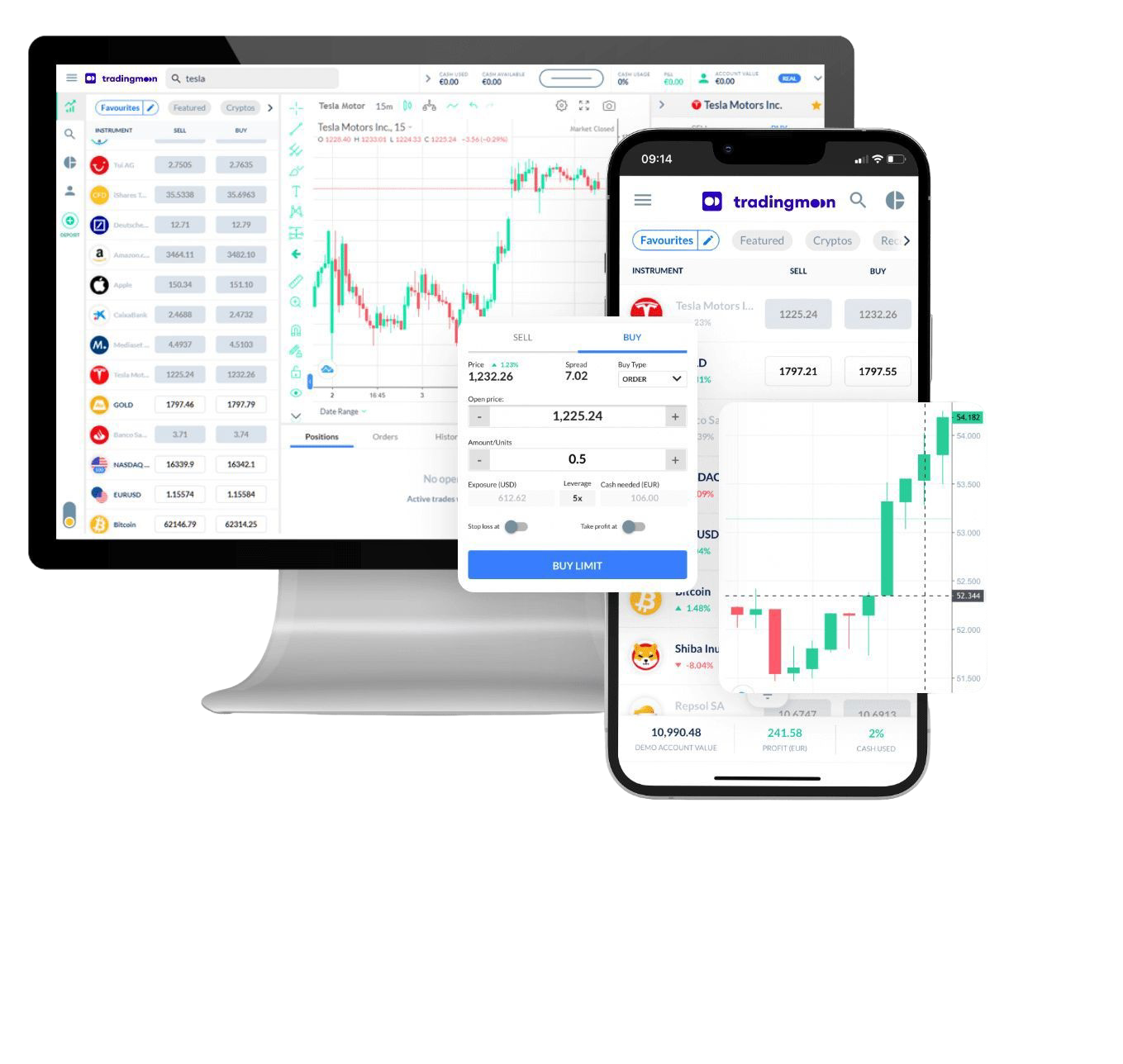

Trade [[data.name]] with TradingMoon

The most popular and trending cryptocurrencies, all in one place at the right time.

- Trade 24/7

- Minimum margin requirement below ~3$

- Spreads of just $0.50 on BTC - lower on other crypto! Plus a super low trading fee of 0.1%/side

- No withdrawal fees

- Diversify! 900+ instruments to choose from

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying crypto asset.

Crypto CFD

Physical Crypto

Capitalise on rising stock prices (go long)

Capitalise on falling crypto prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset or have an exchange account

No exchange fees or complex storage costs

Just lower commissions in the form of spreads and a small taker-fee

Manage risk with in-platform tools

Ability to set take profit and stop loss levels