Loading...

Bitcoin (BTCUSD)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

Bitcoin Price and the Financial Market

Bitcoin, the first decentralized cryptocurrency, is recognized as one of the most influential digital assets in the financial world. Its price plays a crucial role in shaping the dynamics of the broader market. Unlike traditional financial assets like stocks, bonds, and commodities, Bitcoin is not tied to any physical asset or central authority, which makes its price highly volatile. Since its creation in 2009, Bitcoin has gone through numerous phases of growth and contraction, with notable price surges and crashes.

The financial market at large is profoundly influenced by Bitcoin, as it has paved the way for the creation of thousands of other cryptocurrencies. Bitcoin’s impact is far-reaching: institutional investors, hedge funds, and even governments are keeping a close watch on its price movements. This is in large part because Bitcoin has developed a reputation as a hedge against inflation and currency devaluation. The financial world views Bitcoin not only as a digital asset but also as a financial tool that could challenge traditional monetary systems.

The price of Bitcoin is influenced by several factors, including macroeconomic trends, global financial policies, and technological developments. Given its decentralized nature, Bitcoin often reacts to market sentiment and changes in the economic environment, which can lead to rapid fluctuations in its value.

Overview of Current Bitcoin Price Trends

As of late 2024, Bitcoin's price has maintained a significant position within the cryptocurrency market, hovering around $95,000 to $100,000. This is a period of relative stability following the immense volatility Bitcoin experienced in the past. For example, in 2021, Bitcoin surged to an all-time high (ATH) of nearly $69,000 before dropping to around $20,000 in 2022. This volatility has been a hallmark of Bitcoin since its inception, often driven by market speculation and external factors such as regulatory decisions, mainstream adoption, and technological advancements.

Bitcoin’s price trends can often be traced through a Bitcoin chart, which provides historical data on its price fluctuations. From its humble beginnings where 1 BTC was worth only a few cents, it has grown into a digital asset worth tens of thousands of dollars. These trends are crucial for traders and investors as they provide insights into past performance and can offer valuable predictions about future price movements.

Currently, Bitcoin is in a phase of consolidation after its massive highs in 2021. This period of price stabilization is seen by some analysts as a precursor to further upward movement. Institutional involvement in Bitcoin trading and investment is also an influencing factor, with companies like MicroStrategy holding significant amounts of Bitcoin. The overall trend suggests a growing acceptance of Bitcoin as both an investment asset and a viable method of payment.

Current Bitcoin Price Market Trends

The current market trends for Bitcoin reflect a phase of relative calm after several years of market disruptions. Bitcoin’s market price is highly sensitive to a variety of factors, and the market often reacts to news quickly. With institutional investments pouring into the market, Bitcoin has become more embedded in traditional finance. The current price range of Bitcoin reflects the stabilization of its market, where external shocks cause less dramatic price movements than in its early days.

Over the past year, Bitcoin’s price has hovered between $90,000 and $100,000. This price action suggests that the market is digesting significant changes in the global economic environment. Key events such as regulatory announcements, changes in monetary policies, and macroeconomic factors like inflation have a profound effect on the value of Bitcoin. While Bitcoin is still viewed as a volatile asset, these market trends demonstrate that it has matured as a financial tool.

However, the overall market for Bitcoin remains highly speculative. Traders and investors continue to look at Bitcoin price prediction models, such as the stock-to-flow model, which projects that Bitcoin could reach $100,000 in 2024 and potentially $1 million by 2025. While these predictions are based on historical trends, they are not guarantees, as the market remains highly volatile.

Factors That Affect Bitcoin Price and the Bitcoin Market

Several factors influence Bitcoin's price and the market at large. Understanding these factors is key to developing a Bitcoin trading strategy that can navigate Bitcoin’s ups and downs.

1. Supply and Demand Dynamics

Bitcoin operates under a fixed supply model. There will only ever be 21 million Bitcoins, a scarcity feature embedded into its code. This limited supply is one of the main reasons Bitcoin’s price has continued to rise over time. As demand increases—whether from institutional investors, retail traders, or corporations looking to diversify their portfolios—Bitcoin’s price typically increases. In particular, the Bitcoin halving events, which occur roughly every four years, reduce the reward for mining new Bitcoins, effectively decreasing the rate at which new coins enter circulation. This reduction in supply can drive up prices due to the inherent scarcity of the asset.

2. Market Sentiment

Bitcoin’s price is heavily influenced by market sentiment. Positive news—such as major companies accepting Bitcoin or positive Bitcoin price predictions—can spur buying activity, while negative news, like regulatory crackdowns or security breaches, can lead to massive sell-offs. The volatility of Bitcoin makes it particularly susceptible to market sentiment, which can change rapidly. Sentiment can be further amplified by social media trends, celebrity endorsements, and major political figures making statements about Bitcoin.

3. Global Economic Conditions

Bitcoin's price is often influenced by global economic factors such as inflation, interest rates, and central bank policies. When traditional financial systems are under stress, or when inflation rises, Bitcoin is increasingly viewed as a hedge against currency devaluation. This has been particularly true during economic crises, where Bitcoin has risen in price as investors seek to protect their wealth from the traditional financial system. However, the relationship between Bitcoin and traditional economic indicators is not always straightforward, as Bitcoin remains an asset that is influenced by both global events and the speculative nature of cryptocurrency.

4. Technological Advancements

Technological developments can also play a critical role in Bitcoin’s price movements. Innovations in Bitcoin’s network, such as the introduction of scalability solutions like the Lightning Network, make Bitcoin transactions faster and cheaper. These improvements increase Bitcoin’s utility, which in turn can lead to higher adoption rates. On the other hand, concerns over Bitcoin's security or energy consumption can lead to price declines. As the technology evolves, so does its role within the broader financial ecosystem, influencing its price.

Other Related Cryptocurrencies Affected by Bitcoin's Price Action

Bitcoin's price action significantly influences the broader cryptocurrency market, including various altcoins. Cryptocurrencies such as Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA) tend to follow Bitcoin's market trends due to the general market sentiment and correlation between the coins. When Bitcoin experiences sharp price movements, it often leads to cascading effects on altcoins. For example, a Bitcoin rally typically drives a surge in Ethereum and other altcoins, as investor confidence rises. Conversely, Bitcoin's price drop can prompt broader market sell-offs, affecting altcoin valuations.

Additionally, smaller-cap altcoins like Solana (SOL), Polkadot (DOT), and Chainlink (LINK) can be more volatile during these shifts. These assets are heavily influenced by Bitcoin's price action as investors often rotate between Bitcoin and altcoins in response to price changes, seeking either security or higher risk/reward opportunities.

Stablecoins, while designed to maintain a fixed value, are also indirectly impacted. They serve as a safe haven for traders during Bitcoin's market corrections or volatility spikes. However, major market moves originating from Bitcoin can affect liquidity and trading volume, further impacting the broader market ecosystem. Hence, Bitcoin’s price dynamics continue to play a crucial role in shaping altcoin market trends.

Conclusion

The price of Bitcoin remains one of the most discussed topics in the financial world. Whether you are an investor looking to buy Bitcoin or someone interested in Bitcoin’s role in the broader market, understanding the factors that influence its price is essential. From supply and demand dynamics to technological innovations and global economic conditions, Bitcoin’s price is shaped by a complex set of variables. As Bitcoin continues to mature and integrate further into mainstream financial markets, its role as both an asset and a potential currency will likely become even more significant.

By staying informed on Bitcoin price trends, market sentiment, and the broader economic context, you can make more educated decisions when engaging with Bitcoin. Whether you are using a Bitcoin price calculator to determine entry points, or crafting a Bitcoin trading strategy, a thorough understanding of these elements is vital for success.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

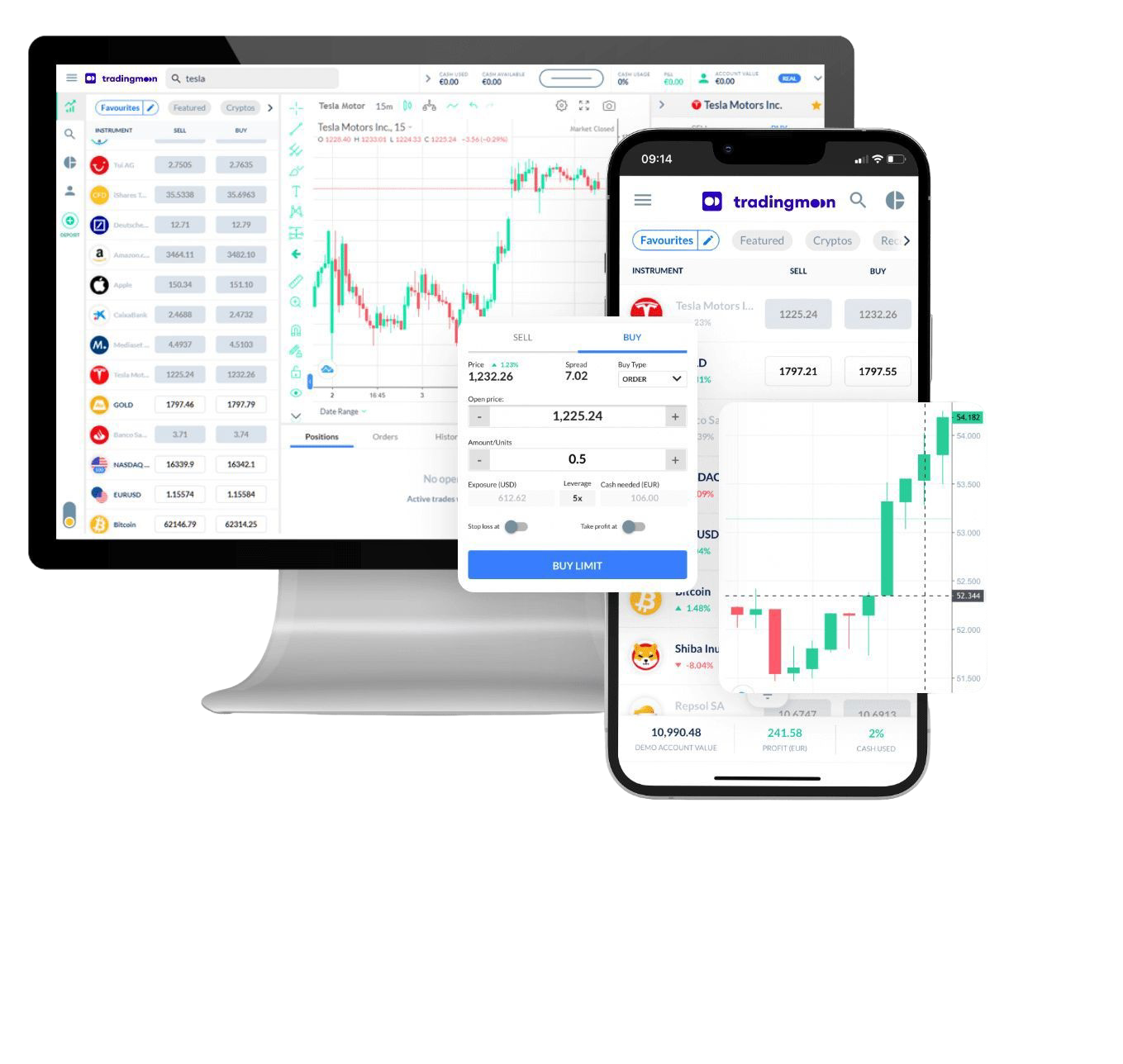

Trade [[data.name]] with TradingMoon

The most popular and trending cryptocurrencies, all in one place at the right time.

- Trade 24/7

- Minimum margin requirement below ~3$

- Spreads of just $0.50 on BTC - lower on other crypto! Plus a super low trading fee of 0.1%/side

- No withdrawal fees

- Diversify! 900+ instruments to choose from

FAQs

How to trade Bitcoin?

+ -Bitcoin trading is a way to make money by speculating on the price of Bitcoin, either through buying and selling Bitcoin directly or through derivatives products. The process involves setting up an account with a cryptocurrency exchange that allows you to buy and sell Bitcoin, as well as other digital currencies. You can then use this account to place orders for buying and selling Bitcoin.

When was Bitcoin released?

+ -Bitcoin was released as open-source software on January 3rd, 2009. It is the first decentralized digital currency and it has no central bank or single administrator. Bitcoin transactions are verified by nodes through cryptography and recorded in a public distributed ledger called a blockchain. Transactions are conducted between users directly, without an intermediary.

What is the future of Bitcoin?

+ -The future of Bitcoin is difficult to predict, as the cryptocurrency continues to evolve and remain unpredictable. The continued growth of Bitcoin has made it a popular asset class for investors, who are looking for potential returns on their investments. As the market matures and more regulations come into effect, we could expect the price of Bitcoin to become increasingly stable.

How to monitor the Bitcoin?

+ -In order to monitor the Bitcoin, it is important to be conscious of the current market conditions. This means that users should be aware of how the price of Bitcoin is fluctuating and what other currencies are being traded against it. Additionally, tracking news releases and industry developments could help inform decisions about when to buy or sell.

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying crypto asset.

Crypto CFD

Physical Crypto

Capitalise on rising stock prices (go long)

Capitalise on falling crypto prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset or have an exchange account

No exchange fees or complex storage costs

Just lower commissions in the form of spreads and a small taker-fee

Manage risk with in-platform tools

Ability to set take profit and stop loss levels