Loading...

Bitcoin Euro (BTCEUR)

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

BTCEUR Price: A Key Indicator in the Financial Market

The BTCEUR price represents the exchange rate between Bitcoin (BTC) and the Euro (EUR), serving as a vital indicator of the cryptocurrency market's performance. As one of the most traded cryptocurrency pairs, the BTCEUR price reflects both the fluctuations in Bitcoin's value and the broader economic conditions impacting the Eurozone. Bitcoin, being a decentralized digital asset, can experience sharp price movements due to market speculation, news, and regulatory developments, while the Euro is influenced by macroeconomic factors such as inflation rates, interest rates, and geopolitical events across the European Union.

Overview of Current BTCEUR Price Trends

In recent weeks, the BTCEUR price has demonstrated notable volatility, reflecting Bitcoin's unpredictable behavior. As of early December 2024, the price of 1 BTC is approximately €90,658, marking a modest increase of 0.1% in the past 24 hours. Over the last month, the price of Bitcoin in Euro terms has risen by around 44.6%, showcasing a strong upward trend compared to the previous period. This surge follows a broader bullish trend in Bitcoin's market, where the price peaked at €95,693.85 in late November, closely approaching its all-time highs.

Current BTCEUR Market Trends

The BTCEUR market is seeing dynamic price changes, with fluctuations occurring frequently within short timeframes. For instance, in the past week, Bitcoin's value ranged between €87,635 and €92,304. The market's volatility is a key characteristic of the cryptocurrency ecosystem, with daily movements as high as 3.7%. Factors contributing to this volatility include investor sentiment, macroeconomic data releases, and Bitcoin's market structure, where a relatively small number of traders and institutional investors can have significant impacts on price action.

Factors Affecting BTCEUR Price and the Market

Several factors influence the price of Bitcoin in Euro terms, making the BTCEUR market highly sensitive to both crypto-specific and global economic developments:

- Global Economic Factors : Economic events such as changes in the European Central Bank's monetary policy or shifts in global inflation expectations can influence the Euro's value, impacting the BTCEUR price. For example, interest rate changes in the EU can make the Euro stronger or weaker relative to Bitcoin, as investors adjust their portfolios based on anticipated returns from traditional assets.

- Bitcoin's Market Sentiment : Bitcoin's price is heavily influenced by market sentiment, driven by factors such as adoption rates, technological developments, and regulatory news. Positive news, like institutional adoption or country-level regulatory clarity, can drive Bitcoin's value up, while negative news—such as security breaches or regulatory crackdowns—can cause sharp sell-offs.

- Supply and Demand Dynamics : The halving event, which reduces the reward for mining Bitcoin, happens every four years and impacts supply. As Bitcoin becomes scarcer, the price often rises if demand continues to increase. This "scarcity" factor plays a crucial role in BTCEUR price movements.

- Market Liquidity and Institutional Involvement : As institutional investors and large-scale traders enter the Bitcoin market, liquidity can increase, potentially leading to more stable price movements. However, institutional involvement can also amplify price swings during high-demand or crisis periods, as seen in other asset markets.

Other Cryptocurrencies Affected by BTCEUR Price Movements

The price action of Bitcoin (BTC) against the euro (EUR), represented by the BTCEUR trading pair, has a significant impact on the broader cryptocurrency market. As Bitcoin remains the dominant digital asset, fluctuations in its price often influence other cryptocurrencies, both directly and indirectly.

Other major cryptocurrencies, such as Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA), tend to move in tandem with Bitcoin, as they often follow its market sentiment. When BTC experiences a price surge or a decline against the euro, it can lead to similar movements in these altcoins, as investors tend to adjust their portfolios based on Bitcoin’s performance.

Smaller altcoins, especially those with lower market capitalization, are even more susceptible to BTC price action. They often face higher volatility, amplifying the effects of Bitcoin’s movements. Additionally, as Bitcoin leads the market, large-scale investors and traders often view BTC price trends as an indicator of broader market sentiment. This triggers either bullish or bearish movements in the altcoin market.

In decentralized finance (DeFi) tokens, such as Uniswap (UNI) or Chainlink (LINK), the correlation is also apparent, as changes in Bitcoin’s price often influence liquidity and trading volumes in these sectors. Overall, Bitcoin's BTCEUR performance remains a key driver of the cryptocurrency market's broader trends.

Developing a BTCEUR Trading Strategy

For traders looking to navigate the BTCEUR market, having a solid trading strategy is essential. The inherent volatility of Bitcoin means that traders need to be prepared for quick changes in market sentiment and price direction. Here are a few key elements to consider when developing a BTCEUR trading strategy:

- Technical Analysis and Charting : Using tools like the BTCEUR chart can provide valuable insights into price trends, potential resistance and support levels, and market momentum. Popular indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help identify optimal entry and exit points for trading.

- Risk Management : Given the volatility of Bitcoin, it's important to use stop-loss orders and risk management techniques to protect your investments. Setting predefined exit points can prevent significant losses during sudden market shifts.

- Diversification : While BTCEUR can be a highly profitable trading pair, diversifying your portfolio by including other cryptocurrencies or commodities can reduce risk. It is wise to monitor not only Bitcoin but also other major cryptocurrencies and traditional financial assets for broader market signals.

BTCEUR Price Prediction

As of December 2024, Bitcoin's price in EUR has shown impressive growth over the past year, with a gain of approximately 168%. Many analysts remain bullish on Bitcoin due to ongoing institutional adoption and the increasing number of use cases in various sectors, including finance and technology. However, predicting the exact trajectory of BTCEUR is challenging due to the volatile nature of both cryptocurrencies and global financial markets. A balanced approach, combining fundamental analysis with technical indicators, will be key for anyone interested in predicting the future direction of BTCEUR prices.

Conclusion

The BTCEUR market remains a dynamic and exciting space for traders and investors alike. Factors such as economic trends, market sentiment, and institutional adoption all contribute to its price fluctuations. Understanding the interplay of these variables, along with developing a solid trading strategy, is essential for anyone looking to buy or sell BTCEUR. As the cryptocurrency market continues to evolve, the BTCEUR pair will remain a key asset for those navigating the world of digital finance. To stay informed on BTCEUR trends and make informed decisions, utilizing tools like the BTCEUR price calculator and following real-time market updates is highly recommended.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

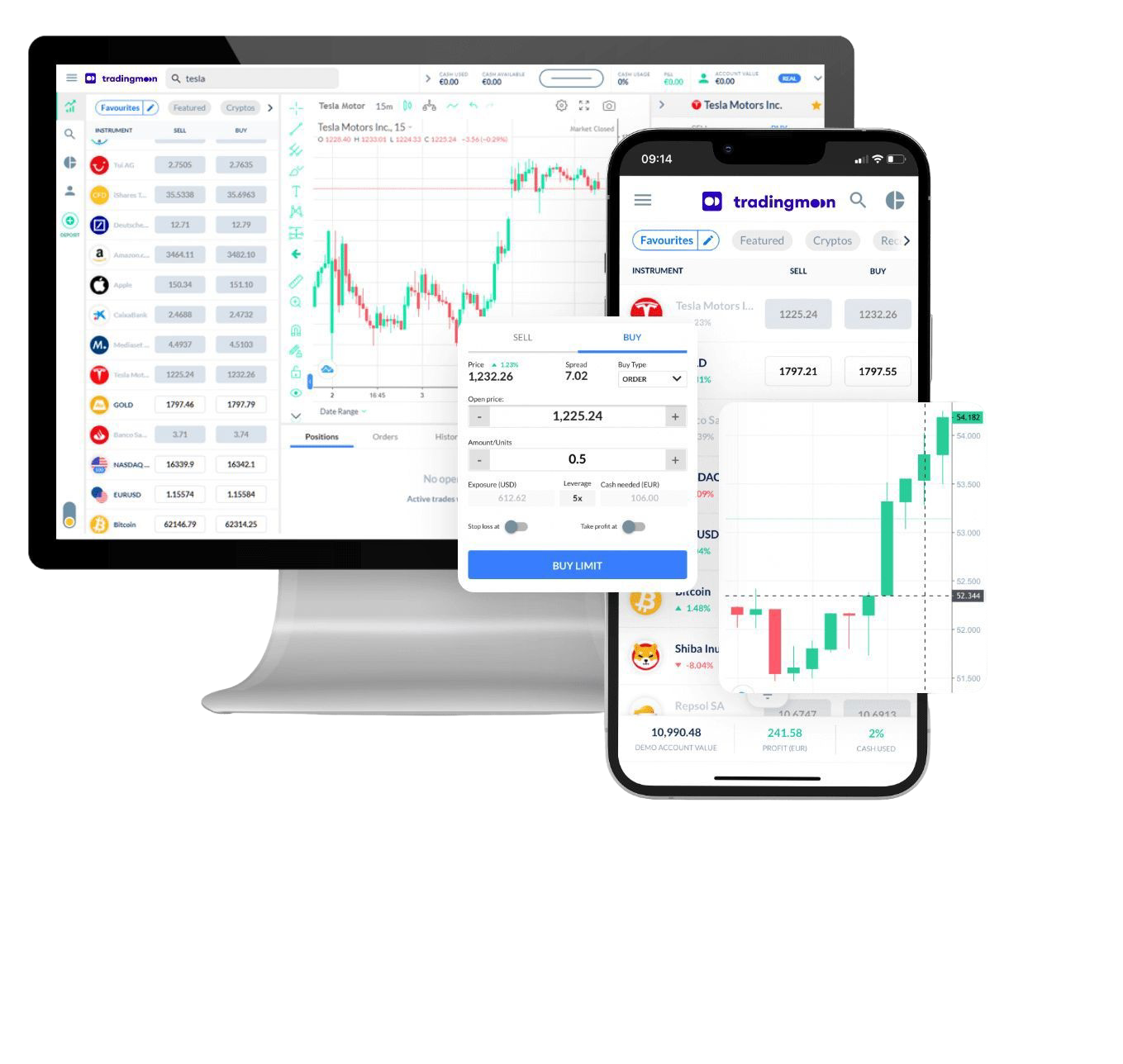

Trade [[data.name]] with TradingMoon

The most popular and trending cryptocurrencies, all in one place at the right time.

- Trade 24/7

- Minimum margin requirement below ~3$

- Spreads of just $0.50 on BTC - lower on other crypto! Plus a super low trading fee of 0.1%/side

- No withdrawal fees

- Diversify! 900+ instruments to choose from

FAQs

How to trade Bitcoin Euro?

+ -If you're looking to trade bitcoin for euros, there are a few things you'll need to take into account. First, you'll need to find a reputable exchange that allows you to trade in BTC/EUR. Once you've found an exchange, you'll need to set up an account and deposit funds into it. Once your account is funded, you'll be able to place orders to buy or sell bitcoin. Alternatively, you can trade BTC EUR via a Broker through Contracts for Difference (CFDs).

When was Bitcoin Euro released?

+ -

Bitcoin Euro was released in 2020 by a group of founders who remain anonymous to this day. The virtual currency had an Initial Coin Offering (ICO) of $1 billion, making it one of the most successful crowdfunding campaigns in history. Bitcoin Euro is a decentralized, peer-to-peer electronic cash system that does not require a central authority or middleman to process transactions. Instead, all transactions are verified and recorded on a blockchain, which is a public ledger of all bitcoin euro activity.

The bitcoin euro system is designed so that there will only ever be 21 million units in circulation. This finite supply makes bitcoin euro a deflationary currency, which means that its value is likely to increase over time as demand increases and more people enter the bitcoin euro market.

What is the future of Bitcoin Euro?

+ -Looking to the future, there is no way to predict what will happen with the BTC/EUR. However, there are a few possible scenarios. First, the currency could become more widely accepted and eventually replace traditional fiat currencies such as the Euro or US dollar. This would require significant adoption by both businesses and consumers. Secondly, the BTC/EUR could continue to exist alongside traditional currencies as an alternative form of payment. Finally, the digital currency could simply disappear if it fails to gain traction with users. No matter what happens, the BTC/EUR is sure to be a project that people will be closely watching in the years to come.

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying crypto asset.

Crypto CFD

Physical Crypto

Capitalise on rising stock prices (go long)

Capitalise on falling crypto prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset or have an exchange account

No exchange fees or complex storage costs

Just lower commissions in the form of spreads and a small taker-fee

Manage risk with in-platform tools

Ability to set take profit and stop loss levels