Loading...

Sugar (SUGAR) Price Chart

[[ data.name ]]

[[ data.ticker ]]

[[ data.price ]] [[ data.change ]] ([[ data.changePercent ]]%)

Low: [[ data.low ]]

High: [[ data.high ]]

A Deep Dive Into Sugar Prices: Current Trends and Market Dynamics

Sugar, a cornerstone of global commodities trading, plays a critical role in financial markets. From sweeteners in foods and beverages to its pivotal role in ethanol production, the sugar market exhibits complexity influenced by a myriad of economic, climatic, and geopolitical factors. This article provides a detailed analysis of the sugar market, including its trends, interconnections with related commodities, and insights into price movements.

Sugar Price in the Financial Market

Sugar is a prominent commodity in global financial markets, primarily traded on exchanges like ICE (Intercontinental Exchange). Sugar No. 11 represents raw sugar futures, while Sugar No. 16 deals with white, refined sugar. These contracts enable producers, refiners, and traders to hedge against price volatility or speculate on future price trends.

Key aspects of sugar trading in financial markets include:

- Hedging: Producers and consumers use sugar futures to protect themselves against price fluctuations caused by weather, supply chain disruptions, and policy changes.

- Speculation: Traders often capitalize on sugar's price volatility for profit, influenced by both fundamental factors (supply-demand dynamics) and technical market indicators.

Sugar’s integration into the renewable energy sector, particularly in ethanol production, creates strong linkages between its price and crude oil trends. Countries like Brazil, where sugarcane-based ethanol production is significant, often influence global sugar prices due to this interdependence

Current Sugar Price Market Trends

The sugar market in 2024 has been marked by significant price volatility. Prices have surged primarily due to climatic disruptions and policy changes in major producing nations, such as Brazil and India.

1. Production Challenges:

- India: Erratic monsoons and export restrictions have reduced global sugar supply. India, a top sugar producer, recently limited exports to prioritize domestic needs, amplifying supply concerns.

- Brazil: A strong Brazilian real has reduced the competitiveness of its sugar exports. However, favorable weather conditions have supported robust production volumes.

2. Bioethanol Demand:

Rising demand for ethanol in the renewable energy sector has further tightened sugar supplies. Governments globally are pushing for ethanol-blended fuels to reduce carbon emissions, directly impacting sugarcane allocation for sugar production.

3. Geopolitical Events:

Political tensions and trade restrictions have disrupted supply chains, driving speculative activity in futures markets.

Sugar futures currently trade around $25-$26 per pound, reflecting a bullish market sentiment. Using a sugar price calculator can help traders assess profit margins in light of these dynamics

Factors That Affect Sugar Prices and the Sugar Market

Sugar prices are influenced by a variety of complex, interrelated factors:

- Weather and Climate:

Sugarcane production is heavily dependent on favorable weather conditions. Droughts, floods, and hurricanes can significantly impact yields. For example, India’s reduced output in 2024 was attributed to deficient rainfall during the monsoon season.

- Government Policies:

Policies on subsidies, tariffs, and export bans play a crucial role in determining market prices. India’s export restrictions and Brazil’s ethanol policies are prime examples of policy-driven price shifts.

- Currency Exchange Rates:

As a globally traded commodity, sugar prices are influenced by currency fluctuations. A stronger Brazilian real has impacted export competitiveness, indirectly boosting global prices.

- Energy Prices:

Sugarcane’s dual role in food and biofuel markets ties its price to energy trends. Rising crude oil prices often drive up sugar demand for ethanol production.

Studying sugar history reveals recurring cycles of price spikes and declines, shaped by these factors. Understanding historical trends is essential for developing a robust sugar trading strategy

Other Related Commodities Affected by Sugar Price Action

Sugar price movements have far-reaching impacts on other commodities:

- Corn:

Sugar and corn are both major inputs for ethanol production. A surge in sugar prices often redirects demand to corn, increasing its prices.

Higher crude oil prices incentivize ethanol production, which can strain sugar supplies allocated for industrial use.

- Coffee and Cocoa:

As soft commodities, coffee and cocoa prices often mirror sugar’s trends due to shared climatic dependencies and production regions.

For those aiming to buy sugar or sell sugar, understanding its interconnections with these commodities is critical for strategic planning.

Strategic Tools and Insights for Sugar Market Participants

Navigating the sugar market effectively requires utilizing analytical tools and market insights:

1. Predictive Analytics:

Tools for sugar price prediction, such as AI-driven models, analyze historical data and market trends to forecast price movements.

2. Sugar Price Calculator:

This tool enables traders to calculate potential profits or losses based on market conditions, offering a practical advantage in dynamic markets.

3. Technical Analysis:

Charts like the silver sugar chart provide valuable insights into price correlations and trends, aiding informed decision-making.

Developing a comprehensive sugar trading strategy that incorporates these tools can significantly improve outcomes for both short-term traders and long-term investors.

Conclusion

The sugar market’s complexity and its interconnections with broader commodity trends make it a fascinating yet challenging domain for investors and traders. By understanding the factors driving sugar prices, staying updated on market trends, and leveraging predictive tools, market participants can better navigate this dynamic landscape.

Whether you are exploring sugar as a soft commodity or considering its role in energy markets, strategic insights and timely analysis are paramount to success. As global demand grows and climate challenges persist, the sugar market will continue to be a vital area of focus for commodities traders and financial analysts alike.

| Swap long | [[ data.swapLong ]] points |

|---|---|

| Swap short | [[ data.swapShort ]] points |

| Spread min | [[ data.stats.minSpread ]] |

| Spread avg | [[ data.stats.avgSpread ]] |

| Min contract size | [[ data.minVolume ]] |

| Min step size | [[ data.stepVolume ]] |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

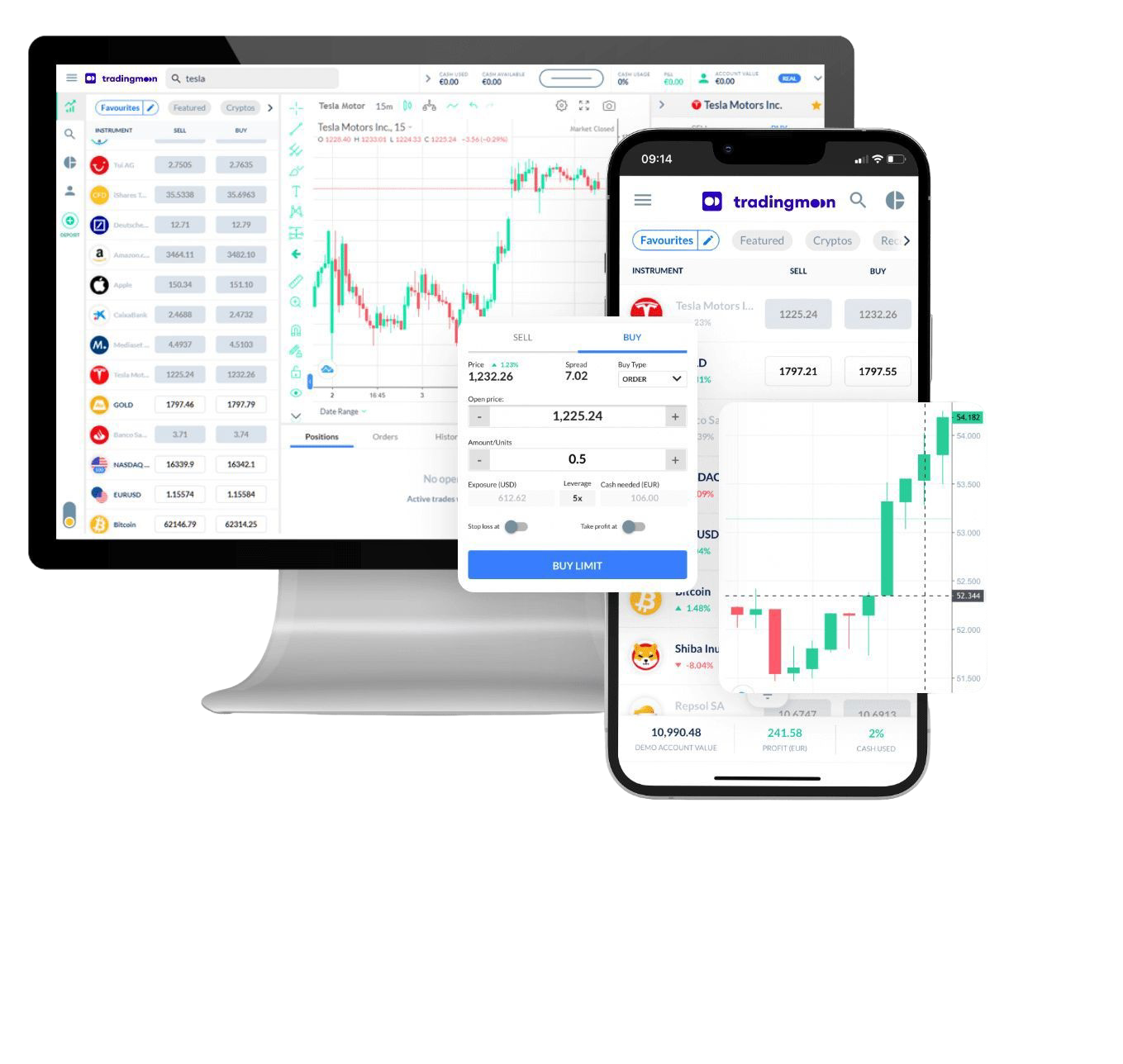

Trade [[data.name]] with TradingMoon

Take a view on the commodity sector! Diversify with a single position.

- Trade 24/5

- Tight spreads

- Average Execution at 5ms

- Easy to use platform

FAQs

What affects Sugar prices?

+ -

In the past, major events have had a notable impact on global sugar prices.

For example, in 2016, increased demand from India caused by a drought in Brazil resulted in an upwards shift in sugar futures. The same year, Hurricane Matthew disrupted the production and supply of sugar cane in the Caribbean region, resulting in higher prices. In 2018, the US-China trade war had an effect on sugar prices too – Chinese import tariffs led to decreased demand and a fall in global sugar prices. It is clear that traders need to be aware of any significant events or changes in policy which may have an impact on the price of sugar. By monitoring such developments and taking appropriate action, traders could profit from changes in the world market.

How to trade Sugar CFD

+ -

Sugar CFDs are a great way to take advantage of price movements in the sugar market. As with any other trading instrument, you need to be aware of the risks involved in taking positions – but done correctly, sugar contracts could offer potentially profitable opportunities. Here's how to get started:

1. Select your broker and check the spreads.

2. Research and study the fundamentals of the sugar market. Learn about seasonal trends which can affect the prices.

3. Choose your trading strategy and make sure you understand the risks of each approach

4. Place an order. Make sure you use a sensible risk-reward ratio and understand the implications of leverage before entering into a position.

5. Manage your position - Keep an eye on the markets and make adjustments as needed. When you’re ready to close out your position, make sure you fully understand the fees and costs associated with doing so.

Sugar CFDs can offer the opportunity for potentially lucrative returns, but it is important to remember that trading carries risk. Make sure you do your research before getting started and always use sensible position sizes in order to manage your risk. Good luck!

What are the other options for trading Sugar?

+ -

If you're looking for an alternative to trading physical sugar, there are a few options worth considering. You can trade sugar-related stocks or contracts for difference (CFD). Trading in stocks gives you exposure to the underlying asset, while CFDs allow traders to speculate on the price movements of existing markets without owning the underlying asset.

Both have different advantages and disadvantages that should be considered when selecting the right product for you. As with any trading, it's important to do your own research, understand the risks involved and make sure you're comfortable before entering a trade. Remember, no matter what type of sugar trading you choose, always use appropriate risk management strategies to protect your capital.

Why Trade [[data.name]]

Make the most of price fluctuations - no matter what direction the price swings and without the restrictions that come with owning the underlying asset.

CFD

Actual Commodities

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Trade on volatility

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels